-

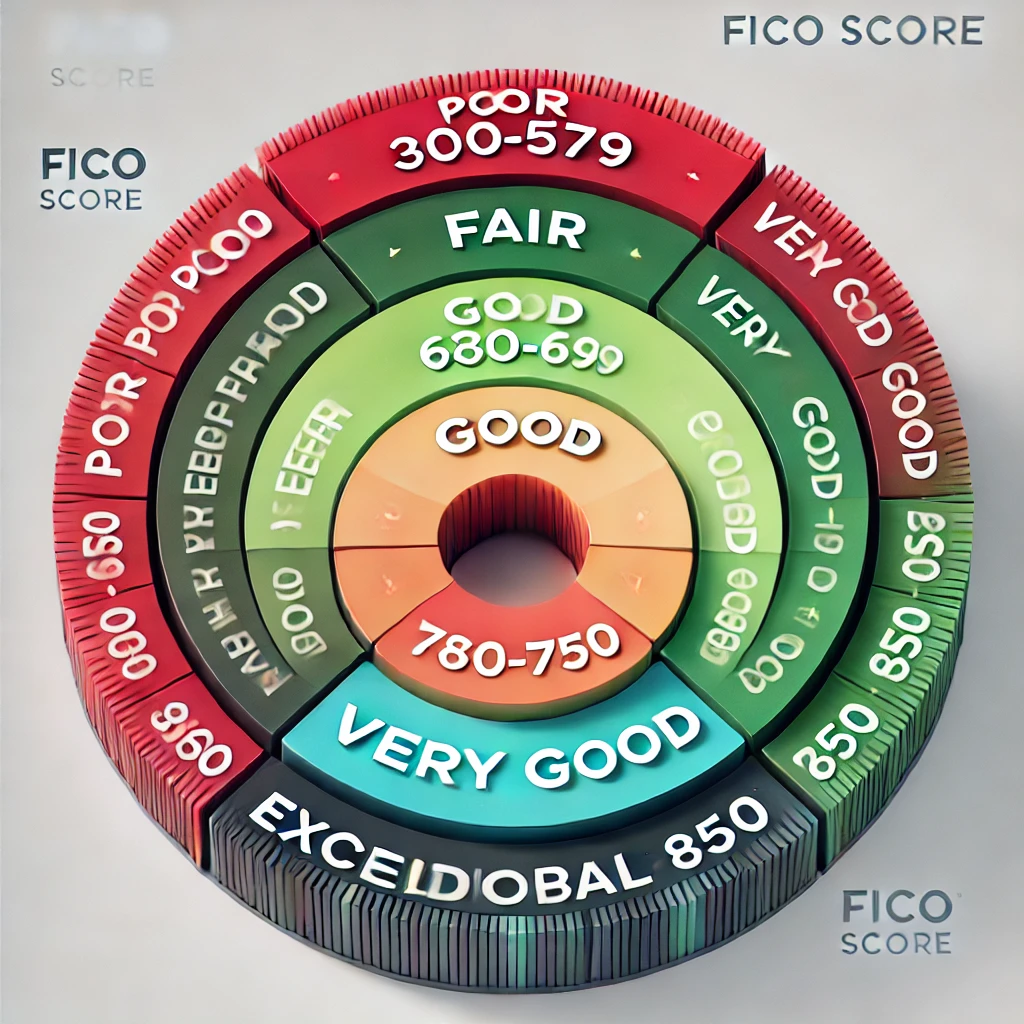

Understanding the FICO Score: Factors That Matter Most

Your FICO score affects loans, interest rates, and credit. Discover the key factors that influence your score and how to improve it.

-

Understanding the Differences Between Soft and Hard Credit Inquiries

Learn how credit inquiries affect your score and how to manage them wisely to protect your financial health.

-

How to Use Credit Responsibly to Boost Your Financial Health

Improve your credit score and financial stability by using credit wisely and avoiding common pitfalls.

-

The Impact of Closing Credit Cards on Your Credit Score

Learn how closing a credit card affects your credit score and when it’s the right move for your finances.

-

How to Monitor Your Credit Report for Errors and Fraud

Protect your financial health by regularly checking your credit report for mistakes and potential fraud.

-

Understanding Credit Utilization and How to Optimize It

Discover how credit utilization affects your score and strategies to keep it at an optimal level.

-

How to Use Secured Credit Cards Responsibly

Build or rebuild your credit with secured credit cards while avoiding common mistakes.

-

The Best Credit Cards for Building Credit in 2025

Find the top credit cards in 2025 designed to help you establish or improve your credit.

-

How to Repair Damaged Credit After Financial Hardship

Recover from financial struggles and rebuild your credit with proven repair strategies.

-

Understanding the Factors That Affect Your Credit Score

Learn what influences your credit score and how to maintain a strong financial profile.

-

How to Build Credit from Zero in 2025

Start from scratch and build a solid credit history with smart financial habits.

-

The Impact of Credit Scores on Debt Management Strategies

Understand how your credit score affects debt repayment options and how to improve it for better financial opportunities.

Categories

- Advanced Investing

- Budgeting & Money Management

- Credit Building & Management

- Cryptocurrency & Blockchain

- Debt Management

- Financial Education & Mindset

- Income Generation

- Insurance & Risk Management

- Investing Basics

- Real Estate & Alternative Investments

- Retirement Planning

- Saving Strategies

- Tax Planning

Credit Building & Management

Elevate your financial profile with comprehensive credit building strategies and maintenance tips. Whether you’re starting from scratch or repairing past issues, we cover everything from choosing the right credit card to disputing inaccuracies on your report. Uncover how credit scores are calculated, why they matter, and how to optimize utilization for long-term gains. Equip yourself with the knowledge to make better borrowing decisions, unlock new opportunities, and safeguard your financial reputation.