In today’s fast-paced digital world, convenience and security in financial transactions are no longer luxuries but necessities. Two major tools have emerged to simplify personal finance management: digital wallets and mobile banking. This article explores both solutions in depth, analyzing their benefits, limitations, and the key factors to consider when choosing the best option for your lifestyle.

Table of Contents

1. The Rise of Digital Finance

Over the last decade, the financial industry has undergone a rapid transformation. Advances in technology have spurred the development of tools that streamline transactions, enhance security, and offer a user-friendly banking experience—all accessible via your smartphone.

- Mobile wallets became popular through services like Google Pay, Apple Pay, and Samsung Pay, allowing quick payments at stores or online checkouts.

- Mobile banking apps from established banks also evolved, offering a wide range of services from fund transfers to check deposits—all without stepping foot inside a physical bank.

The choice between these two solutions often hinges on personal preference and the specific features a consumer deems most valuable. However, understanding both options more deeply will guide you toward the smartest approach to managing your finances.

2. Digital Wallets Explained

A digital wallet is a software-based system that securely stores users’ payment information and passwords for numerous payment methods and websites. It enables users to make electronic transactions quickly and safely. Beyond just credit and debit cards, digital wallets can also store loyalty cards, coupons, event tickets, and even identification credentials in some regions.

Key Advantages

- Instant Access: Your payment details are stored on your smartphone or wearable device, eliminating the need to carry physical cards.

- Enhanced Security: Through tokenization, biometric authentication (fingerprint or face ID), and encryption, digital wallets reduce the risks of carrying physical cash or cards.

- Unified Platform: Store multiple cards and coupons in one place, making purchases more streamlined than ever.

Potential Drawbacks

- Limited Acceptance: Not all merchants support digital wallets—though acceptance is growing rapidly.

- Device Dependence: If your phone battery dies or you lose your device, you might be temporarily locked out of your payment methods.

- International Constraints: Some digital wallets have geographical limitations, so traveling may require additional payment options.

3. Mobile Banking: The All-in-One Financial Hub

Mobile banking refers to the use of a dedicated app or web platform provided by your bank. It allows complete control over your finances: viewing statements, making transfers, paying bills, depositing checks via smartphone camera, and in many cases, applying for loans or managing investment portfolios.

Key Advantages

- Comprehensive Financial Management: You can monitor multiple accounts (checking, savings, credit lines) and even manage investments in one place.

- Widespread Acceptance: The majority of banks worldwide now support well-developed, fully functional mobile banking apps.

- 24/7 Accessibility: Mobile banking grants immediate account access to perform tasks like transferring money or paying bills, regardless of your location.

Potential Drawbacks

- Complexity: With so many features packed into one platform, first-time users can find it overwhelming.

- Security Concerns: While banks use robust security measures, risks include phishing scams, insecure Wi-Fi networks, and potential device theft.

- Possible Fees: Some transactions—like certain wire transfers—still incur fees that may not be clearly visible until after you initiate the process.

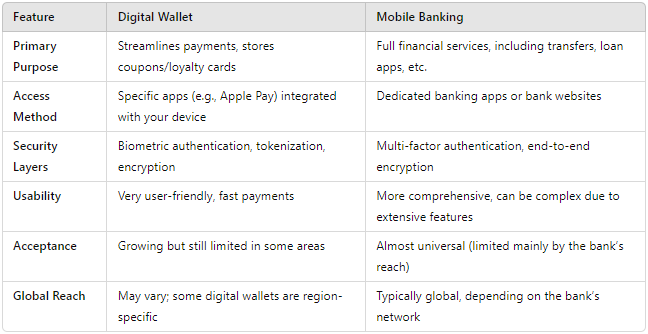

4. Side-by-Side Comparison

Below is a quick reference table outlining the fundamental differences between digital wallets and mobile banking:

5. How They Complement Each Other

It’s important to note that digital wallets and mobile banking aren’t necessarily competing services. They often work together to offer a more robust financial management system:

- Synchronize Credit/Debit Cards: The cards you link to your digital wallet come from your bank account.

- Use a Wallet for Daily Spending: Enjoy quick payments for coffee, groceries, or online shopping.

- Rely on Mobile Banking for Deeper Insights: Track your balance, schedule bill payments, and review transaction histories in detail.

6. Trends and Innovations

- Integration with Wearables: Smartwatches and fitness trackers are integrating digital wallet functionality, making payments even more seamless.

- AI-Based Insights: Mobile banking apps increasingly include AI-driven analytics that can automatically categorize spending and offer personalized saving or investment tips.

- Biometric Security: Both platforms are moving beyond fingerprints to facial recognition and even palm scans for authentication.

- Expansion Beyond Payments: Many digital wallets now let you store vaccine passes, membership IDs, or public transportation tickets, broadening their utility.

7. Choosing the Best Option for You

Before choosing between digital wallets and mobile banking (or deciding to use both), consider the following factors:

- Frequency of Transactions

- If you frequently buy small items, a digital wallet may suit your fast-paced lifestyle.

- If you perform more complex transactions such as international wire transfers or loan payments, mobile banking is indispensable.

- Comfort with Technology

- Digital wallets are generally simpler for everyday purchases.

- Mobile banking apps require navigating multiple features and services.

- Security Preferences

- Both use robust security measures, but carefully follow best practices:

- Use strong passwords or passphrases.

- Enable biometric authentication if available.

- Avoid unsecured public Wi-Fi for any financial transactions.

- Both use robust security measures, but carefully follow best practices:

- Global Use

- Traveling frequently? Check if your digital wallet supports your destination’s currency and local payment networks.

- Your bank’s mobile app likely works globally, but certain countries may restrict international banking features.

8. Practical Tips to Maximize Security

- Enable Notifications: Real-time alerts for deposits, withdrawals, or unusual activity help you detect fraud faster.

- Keep Apps Updated: Always install the latest version to benefit from the newest security patches.

- Review Statements Regularly: Whether you use a digital wallet or mobile banking, go over each transaction.

- Separate Bank Accounts for Different Needs: One for everyday use (linked to your digital wallet), and another for savings.

9. Conclusion

Digital wallets and mobile banking are reshaping the way we interact with money. As technology continues to evolve, these platforms will offer even more integrated, secure, and personalized services. By understanding the unique advantages of each, you can tailor a financial strategy that maximizes convenience and safeguards your assets. Whether you lean toward quick payments via a digital wallet or prefer comprehensive oversight through a mobile banking app—or both—the future of finance is literally at your fingertips.