High-yield savings accounts (often shortened to HYSAs) have become a cornerstone of secure wealth-building for those who want their money to grow faster than it would in a traditional savings account. With economic trends suggesting that interest rates may stay competitive in 2025, there has never been a better time to park your money in a high-yield account. In this comprehensive guide, you’ll discover the best high-yield savings accounts for 2025 and learn exactly how to choose, open, and manage the right one for your financial goals.

Table of Contents

1. Why High-Yield Savings Accounts Matter in 2025

The year 2025 is poised to be a turning point for savers. Economic indicators suggest that interest rates could remain relatively high, making it possible to earn a competitive annual percentage yield (APY) on your savings. Traditional savings accounts, with rates sometimes as low as 0.01%, are no match for the growing cost of living and inflation pressures.

- Inflation Defense: Stashing money in a high-yield savings account is a practical way to keep pace with inflation. If your APY is higher than the inflation rate, your money retains or even gains value.

- Financial Flexibility: Whether you’re saving for a down payment on a home, an emergency fund, or a dream vacation, having your funds grow faster can shorten the time it takes to reach your goal.

- Online Convenience: Most high-yield savings accounts are offered by online banks that leverage digital platforms. This usually means lower overhead costs and higher interest rates for customers.

Authoritative Link: To see how inflation trends influence savings, visit the Federal Reserve’s economic data for regular updates on interest rate policies.

2. Understanding High-Yield Savings Accounts

A high-yield savings account is a specialized deposit account designed to offer a significantly higher APY compared to standard savings accounts. While a traditional bank might offer an APY of 0.01% to 0.10%, a high-yield savings account can easily range from 2.00% to 5.00% (or sometimes even higher), depending on the market and bank.

2.1 How Do They Differ from Traditional Savings Accounts?

- Interest Rates: The most obvious difference is the APY. Online-focused banks can typically pass savings on to consumers in the form of higher rates because they spend less on physical branch networks.

- Access: Withdrawals and deposits are usually conducted online or via a mobile app. Some high-yield accounts offer ATM cards for added convenience, though they are less common than in checking accounts.

- Fees: Many high-yield savings accounts do not charge monthly maintenance fees. In contrast, some traditional savings accounts may charge monthly fees if you don’t meet specific balance requirements.

2.2 FDIC or NCUA Insurance

When you open a high-yield savings account at a bank, your deposits are typically insured up to $250,000 by the Federal Deposit Insurance Corporation (FDIC). If you opt for a credit union, the National Credit Union Administration (NCUA) provides a similar level of protection. This government-backed insurance is crucial for preserving trust and security.

Authoritative Link: Confirm your bank’s FDIC insurance status at the official FDIC website.

3. Key Benefits of a High-Yield Savings Account

3.1 Competitive Rates

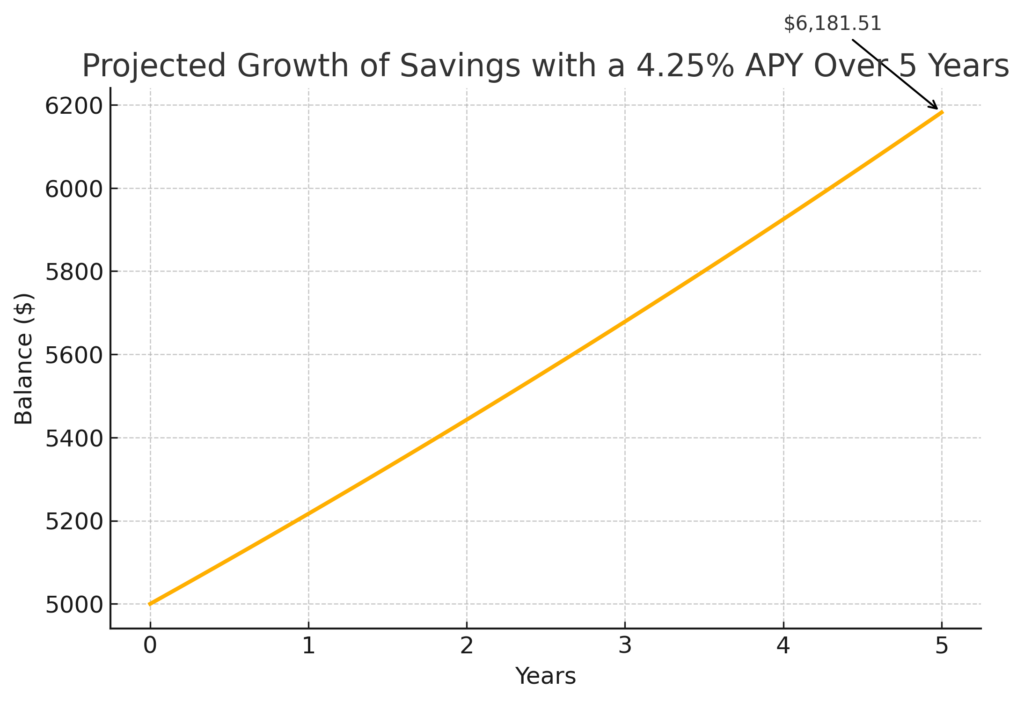

High-yield savings accounts can help combat inflation by providing interest rates that outpace those of standard savings accounts. This can be especially significant over several years.

3.2 Low Risk

Unlike stocks, bonds, or cryptocurrencies, high-yield savings accounts offer a virtually risk-free environment (as long as you stay within insurance limits). Your principal doesn’t fluctuate based on market conditions.

3.3 Liquidity and Flexibility

Unlike certificates of deposit (CDs), which lock in your funds for a set period, high-yield savings accounts allow you to withdraw or transfer money more freely, often without penalties.

3.4 Straightforward Setup

Most online banks allow you to open and fund an account within minutes. The process typically involves basic personal details, identification, and linking an external bank account for initial funding.

3.5 Ideal for Short-Term Goals

High-yield savings accounts are especially useful for short-term financial goals—such as saving for a wedding, a car, or an emergency fund—where stability and easy access matter more than the potentially higher (but riskier) returns of stocks or mutual funds.

4. E-E-A-T in Action: Ensuring Trust in Your Savings

4.1 Experience

When selecting a high-yield savings account, consider firsthand experiences from friends, family, and online reviews. Many customers share their satisfaction or dissatisfaction on reputable finance forums. This “on-the-ground” feedback can offer real insights into customer support, ease of account management, and any unexpected fees.

4.2 Expertise

Look for banks that specialize in savings products or have a strong track record in personal finance. An institution that is widely recognized for competitive rates and transparent policies is more likely to deliver a consistently good experience.

4.3 Authoritativeness

Check whether the financial institution you’re considering is frequently cited by major media outlets or receives high ratings from industry watchdogs. Recognition from established resources such as Forbes, The Wall Street Journal, or Consumer Reports adds credibility.

4.4 Trustworthiness

Finally, ensure the bank is FDIC-insured (or NCUA-insured if it’s a credit union). Read through the terms and conditions carefully. Look for clear disclosure of fees, including any potential fees for excessive transfers.

5. 7 Best High-Yield Savings Accounts for 2025

Below is a more in-depth look at seven standout high-yield savings accounts for 2025. Each has been selected based on interest rates, fee structures, and overall user experience. Keep in mind that APYs can change, so always confirm current rates with the bank.

(Note: APYs are examples and subject to change. Always verify the latest rates.)

5.1 Ally Bank

- Why It Stands Out: Ally Bank consistently ranks among the top choices for high-yield savings. It has no monthly maintenance fees and no minimum balance requirements.

- Experience Factor: Users often praise Ally’s round-the-clock customer service and intuitive app. Transactions—whether deposits or withdrawals—are quick, and their chat support is responsive.

- Extra Perks: Ally sometimes runs limited-time promotions offering higher APYs. Keep an eye on their website for such deals.

5.2 Marcus by Goldman Sachs

- Why It Stands Out: Backed by the globally recognized Goldman Sachs brand, Marcus frequently provides a competitive APY.

- Authoritativeness: Goldman Sachs has a storied history in investment banking. This expertise and brand reliability extend to its consumer-facing Marcus products.

- Features: The account requires no minimum deposit, making it easy for new savers to start growing their money right away.

5.3 Discover Bank

- Why It Stands Out: Known for its credit cards, Discover Bank has also entered the online savings scene with strong APYs and minimal fees.

- Promotion Offers: Discover periodically offers cash bonuses for opening a new savings account and meeting certain deposit requirements.

- Accessibility: The bank’s mobile app is robust, and the website features a straightforward interface.

5.4 Capital One 360

- Why It Stands Out: Capital One 360 integrates seamlessly with the Capital One ecosystem, including credit cards and checking accounts.

- Low Barrier: No minimum balance requirements and no monthly fees.

- Trusted Brand: Capital One is a major name in consumer banking, adding a layer of trustworthiness.

5.5 Synchrony Bank

- Why It Stands Out: Synchrony often leads the market in APY. It also offers an ATM card with its savings account, which is somewhat unique among online banks.

- Customer Feedback: Many customers appreciate the straightforward sign-up process and the user-friendly online portal.

- Ideal For: Those who want an online-based account with occasional in-person access through ATMs.

5.6 CIT Bank

- Why It Stands Out: CIT Bank’s “Savings Builder” and “Savings Connect” products often feature tiered APYs, rewarding higher balances or regular deposits with enhanced rates.

- Expertise: Part of First Citizens Bank, CIT has a long history in providing commercial financing, which translates into robust consumer banking products.

- Potential Downsides: A $100 minimum deposit is required to open most of their savings accounts. Still, that’s a relatively low barrier.

5.7 Varo Bank

- Why It Stands Out: Varo is one of the first U.S. fintech companies to receive a national bank charter, offering up to 5% APY for qualifying customers.

- Mobile-First Approach: Designed primarily for mobile users, Varo’s app is where most transactions and account management happen.

- Qualification Criteria: To earn the highest APY, you typically need to meet conditions such as maintaining a certain balance or receiving direct deposits.

6. How to Choose the Right HYSA for You

Selecting the “best” high-yield savings account ultimately depends on your personal financial goals and preferences. Consider these factors:

- APY Consistency

- Look for banks that have historically maintained competitive rates, not just promotional offers that drop after a few months.

- Fee Structure

- Aim for accounts with no monthly maintenance fees. Fees can significantly cut into your earnings.

- Accessibility and Interface

- If you’re comfortable with online banking, a mobile-first bank might be ideal. If you prefer occasional in-person service, check if the bank offers ATM access or has partner networks.

- Customer Service

- Read reviews or ask friends for their experiences. Quick and efficient support can save you headaches down the line.

- Account Linking

- Some banks make it easier to link your external checking account for quick transfers. The speed and simplicity of these transfers can matter a lot if you need funds on short notice.

- Additional Features

- Consider whether you want advanced tools like goal trackers, automatic savings plans, or the ability to open multiple savings “sub-accounts” for different goals.

7. Opening a High-Yield Savings Account: A Step-by-Step Guide

7.1 Research

- Visit trusted financial comparison sites (e.g., NerdWallet, Bankrate) to see current APYs and user ratings.

- Check each bank’s website to confirm the details, especially promotions and fees.

7.2 Gather Documents

- Government-Issued ID: A driver’s license or passport.

- Social Security Number: For identity verification.

- Proof of Address: A utility bill or bank statement in your name if needed.

7.3 Apply

- Online Application: Most banks allow you to fill out an application on their website or through a mobile app.

- Personal Details: Provide your name, address, SSN, and contact information.

- Initial Deposit: You’ll likely link an external checking account to transfer your initial deposit. Some banks allow you to mail in a check if you prefer.

7.4 Fund Your Account

- Electronic Transfer: Typically, the easiest and fastest method.

- Check Deposit: This can take longer, especially if you’re using mail.

7.5 Start Earning Interest

- Monitor APYs: Rates can fluctuate, so stay informed.

- Set Up Auto-Transfers: Automating deposits ensures you consistently grow your savings.

8. Real-Life Examples and Success Stories

8.1 Sarah’s Emergency Fund

- Scenario: Sarah started with $2,000 in a traditional savings account at 0.01% APY. She discovered high-yield savings accounts offering 4% APY.

- Action: Sarah transferred her $2,000 into a high-yield account and set up a monthly auto-deposit of $200.

- Result: After one year, her balance surpassed $4,500, with over $100 in interest—significantly more than she’d have earned at her old bank. Now, she’s on track to build a comfortable emergency fund in less time.

8.2 Mike’s Short-Term Business Goal

- Scenario: Mike planned to start a small food truck venture and needed $10,000 to buy equipment.

- Action: He opened an HYSA at an online-only bank offering 4.5% APY. He deposited $7,000 initially and contributed $500 each month.

- Result: In just over six months, he met his $10,000 target, aided by a few extra dollars in interest. This faster growth helped him launch his business on schedule.

8.3 Family Vacation Fund

- Scenario: A couple wanted to plan a dream family vacation in two years, estimating a total cost of $8,000.

- Action: They opened a joint high-yield savings account at 4.2% APY and deposited $3,000. By consistently contributing $200 monthly, they steadily built their fund.

- Result: They reached their goal with enough left over for a few extra vacation perks, thanks to the interest earned.

9. Expert Tips for Maximizing Your Savings

- Automate Everything

- Schedule automatic monthly transfers from your checking to your HYSA. This “set it and forget it” approach helps maintain consistent contributions.

- Limit Withdrawals

- While high-yield savings accounts are more flexible than CDs, frequent withdrawals reduce the compounding effect. Consider keeping separate accounts for different goals to avoid tapping your core savings fund.

- Shop Around

- Periodically compare interest rates, especially if you notice your APY dropping. Some banks offer loyalty bonuses or seasonal promotions to attract savers.

- Use Multiple HYSAs

- If you have multiple financial goals—like an emergency fund, vacation fund, and home down payment—consider opening multiple high-yield accounts. This strategy provides better organization and clarity.

- Stay Informed on Interest Rate Trends

- The Federal Reserve’s monetary policy can influence your account’s APY. Keep an eye on official announcements and adapt your savings strategy accordingly.

Frequently Asked Questions (FAQs)

1. Are High-Yield Savings Accounts Risk-Free?

As long as the bank is FDIC-insured (or NCUA-insured for credit unions), your funds up to $250,000 are protected. This makes HYSAs one of the safest places to keep your money outside of government-issued securities.

2. How Often Can I Withdraw Money?

Under federal Regulation D, savings accounts used to be limited to six withdrawals per statement cycle. Although some restrictions have been relaxed, many banks still enforce monthly withdrawal limits to encourage saving. Always check your bank’s specific policy.

3. Do I Need a Large Initial Deposit?

Not necessarily. Many online banks set no or very low minimum deposit requirements. Even if there is a requirement, it’s usually more modest than for other investment products like CDs.

4. Will My APY Stay the Same?

APYs are variable and can change at any time based on market conditions. If you notice your rate dropping significantly, you can always move your funds to another bank offering a better rate.

5. Can I Use a High-Yield Savings Account for Everyday Spending?

While it’s technically possible to withdraw funds for any reason, high-yield savings accounts are best suited for saving, not day-to-day transactions. Frequent withdrawals not only reduce the time your money spends earning interest but could also incur fees if you exceed monthly limits.

6. How Do I Know if a Bank Is Trustworthy?

Look for:

Long-standing history or affiliation with a reputable financial institution.

FDIC (bank) or NCUA (credit union) insurance.

Positive user reviews and industry recognition.

Transparent fee disclosures.

Good customer service reputation.

7. Should I Consider Multiple High-Yield Savings Accounts?

Yes, if you have distinct financial goals—like an emergency fund, vacation fund, or car fund—having separate HYSAs can simplify tracking and enhance organization.

Conclusion

High-yield savings accounts are an excellent tool for growing your money securely in 2025. By choosing an account with a consistently competitive APY, low or no fees, and robust digital tools, you can stay ahead of inflation and meet your financial goals more quickly. Whether you’re building an emergency fund, saving for a specific milestone, or simply looking for a reliable way to earn interest, a high-yield savings account checks all the boxes.

Key Takeaways:

- Focus on Trusted Institutions: Ensure FDIC or NCUA insurance and a solid reputation.

- Compare Rates and Features: Don’t just chase the highest APY; consider fees, customer service, and ease of use.

- Set Clear Goals: Use your HYSA for short- to medium-term objectives where liquidity matters.

- Stay Proactive: Keep an eye on evolving APYs, promotions, and new offerings to continually optimize your savings.

- Enjoy the Rewards: By letting your money work harder, you’ll reach your financial objectives faster and with greater peace of mind.

Take the next step: Open a high-yield savings account that aligns with your goals and start watching your savings grow. In a financial landscape where every dollar counts, maximizing your interest earnings has never been more vital—or more achievable. Make 2025 the year you elevate your savings strategy and secure a stronger financial future.