Introduction

If you’ve ever wondered how investors decide whether a stock is priced “fairly” or not, you’re likely already dealing with the Price-to-Earnings (P/E) ratio—perhaps without even realizing it. The P/E ratio is one of the most common metrics in finance, widely used by both beginners and experienced investors to gauge a stock’s valuation relative to its earnings. But what does P/E ratio really tell us, and how can you use it to make more informed investment decisions?

In this article, we’ll break down the P/E ratio in plain language: how it’s calculated, how to interpret it, and why it can both guide and mislead you at the same time. By the end, you’ll have a solid understanding of how to spot potentially undervalued (or overvalued) stocks and feel more confident navigating the stock market.

Table of Contents

What is the P/E Ratio?

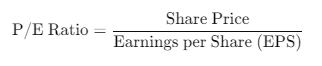

The Price-to-Earnings ratio is exactly what it sounds like: a comparison of a company’s share price (P) to its earnings per share (E). In simple terms, the P/E ratio shows how much you, as an investor, are paying for each dollar of a company’s earnings.

- Share Price (P): The current market price of one share of the company’s stock.

- Earnings per Share (EPS): A company’s net income divided by the number of outstanding shares.

So if a company’s stock trades at $50 per share and its EPS over the last 12 months (known as TTM or “trailing twelve months”) is $2, its P/E ratio would be 25 (50/2).

Types of P/E Ratios

While the basic concept is straightforward, you’ll often come across a few different flavors of the P/E ratio. Each has its own nuances:

- Trailing P/E

- Uses earnings data from the past 12 months.

- Considered more “real” because it’s based on actual, historical numbers.

- Forward P/E

- Uses analyst projections of future earnings.

- More speculative, but can offer insight into expected growth.

- Mixed or Current P/E

- A combination of historical and partial future earnings (for example, if a company’s fiscal year isn’t complete yet).

- Less common, but you may see it in certain reports.

In general, you’ll encounter trailing and forward P/E ratios most frequently. It’s wise to understand which version the media or analysts are quoting when discussing a particular stock.

Why is the P/E Ratio Important?

- Easy Comparison Across Companies: The P/E ratio lets you compare companies of different sizes and sectors quickly. A P/E of 10 in one industry can be cheap, while a P/E of 10 in a fast-growing tech sector might be considered expensive—or vice versa.

- Helps Spot Potential Bargains: If a stock’s price is low relative to its earnings, it could indicate a good buying opportunity. However, a low P/E can also be a red flag if the market is pricing in major risks or stagnant earnings.

- Reflects Market Sentiment: A high P/E ratio often signals that investors are expecting substantial future growth. Meanwhile, a low P/E could suggest low growth expectations or broad pessimism about the company.

How to Calculate the P/E Ratio Step by Step

- Find the Stock’s Current Price

- Check a reliable source like Yahoo Finance, Google Finance, or a brokerage platform.

- Determine the EPS

- Look at the company’s income statement to find net income.

- Divide net income by the number of outstanding shares.

- Alternatively, most financial websites and brokerage accounts list EPS directly.

- Divide Price by Earnings per Share

- Just take the share price and divide by EPS.

- Make sure you know whether the EPS is TTM (trailing) or forward projected.

Example:

- Stock Price = $100

- EPS = $5 (trailing 12 months)

- P/E = 100 / 5 = 20

In this example, an investor is paying $20 for every $1 of annual earnings the company generates.

Interpreting the P/E Ratio

- High P/E:

- Indicates that the stock is “expensive” relative to its earnings.

- But it might also suggest investors expect rapid earnings growth, justifying a higher price.

- Low P/E:

- Suggests the stock may be undervalued, or the market has low expectations for its future earnings.

- Value investors often seek out lower P/E ratios, but caution is necessary. A cheap stock can stay cheap for valid reasons.

One crucial point: A “good” P/E isn’t fixed. Different industries have different average P/E ranges. Tech companies often sport higher ratios due to fast growth potential, while utilities might have lower ratios because of stable but slower growth.

When a High P/E is Worth It

Sometimes, a high P/E ratio is justified:

- Strong Growth Prospects

- Companies like Tesla or Amazon have historically had elevated P/E ratios because investors foresee significant revenue and profit expansion.

- Innovative Products or Services

- If a firm is pioneering a new technology or market, the potential payoff could be huge. Investors are willing to pay a premium now for what they believe will be blockbuster profits later.

- Industry Disruption

- A company disrupting an old industry (think Netflix vs. traditional media) can command a high P/E, reflecting market optimism about the disruption’s success.

However, lofty P/E ratios can backfire if growth disappoints. That’s why it’s critical to combine the P/E ratio with other research—like revenue trends, competition, and overall market conditions.

When a Low P/E is a Red Flag

On the flip side, a rock-bottom P/E ratio may look like a dream for bargain hunters, but it can be too good to be true:

- Declining Earnings

- If earnings are falling faster than the share price, the P/E might look artificially low.

- A sudden earnings collapse could signal deeper problems.

- Legal or Regulatory Hurdles

- Pending lawsuits or heavy regulatory scrutiny can significantly hamper future earnings.

- The market might be pricing in these risks.

- Industry Headwinds

- If the entire sector is struggling (for example, oil companies during a major drop in oil prices), P/E ratios might plunge.

- A low P/E in a downtrend doesn’t necessarily mean a value opportunity.

A low P/E can be an opportunity only if you believe the issues holding down earnings or the stock price are temporary and fixable.

Limitations of the P/E Ratio

While the P/E ratio is one of the most popular valuation metrics, it’s not perfect. Here’s why:

- One-Dimensional

- It only shows the relationship between price and earnings. You won’t see details like a company’s debt, cash flow, or profit margins.

- Earnings Can Be Manipulated

- Earnings are subject to accounting policies; companies sometimes adjust figures in ways that make EPS look better (or worse) than reality.

- Ignores Growth Rates

- A P/E ratio doesn’t show how fast earnings are growing. A company with high growth might deserve a higher P/E than a slow-growth competitor.

- Many investors use the PEG ratio (P/E to Growth) to account for that.

- Market Sentiment Swings

- In a market bubble, P/E ratios can skyrocket without fundamental justification.

- In a recession, even good companies can see their P/E ratios slump.

Because of these limitations, it’s wise to use additional metrics such as PEG ratio, Price-to-Book (P/B) ratio, and Return on Equity (ROE) for a fuller picture.

Practical Tips for Using the P/E Ratio

- Compare Within the Same Sector

- Always evaluate P/E ratios among industry peers. Different sectors have different typical P/E levels.

- Check Trends

- Look at how a company’s P/E has changed over time. Is it steadily rising, indicating growing optimism, or is it falling?

- Combine with Fundamentals

- Investigate revenue growth, profit margins, debt levels, and market share. A robust fundamental picture supports the P/E story.

- Don’t Panic Over Short-Term Earnings Swings

- One quarter’s earnings miss can skew the ratio. Look at multiple quarters or trailing twelve months.

- Use Forward P/E Cautiously

- Projections can be overly optimistic. Always consider the source of the estimates and possible biases.

Real-World Example: Tech vs. Utilities

- Tech Giant (High P/E): Suppose a major tech company has a P/E ratio of 35. That may seem steep, but if the firm is growing revenues by 30% per year and expanding into new markets, investors might decide it’s worth paying a premium.

- Utility Company (Low P/E): A local utility with a stable customer base might trade at a P/E of 12. That doesn’t necessarily mean it’s “cheap.” Its lower ratio reflects slower growth prospects and stable but modest profits.

Action Steps: Put the P/E Ratio to Work

- Pick a Few Stocks: Start with companies you know or have heard about.

- Find Their P/E Ratios: Use a reputable financial site or your brokerage account.

- Compare Across the Same Sector: See if one company’s ratio significantly differs from the industry average.

- Dig Deeper: Look for potential reasons—are they innovating, facing lawsuits, or expanding internationally?

- Monitor Over Time: Track the P/E ratio monthly or quarterly to see how market sentiment evolves.

Remember, the P/E ratio is just one piece of the puzzle. It’s a powerful starting point, but successful investing also depends on understanding the company’s business model, leadership, competitive environment, and broader economic trends.

Conclusion

The P/E ratio remains one of the most talked-about valuation tools for a reason: it offers a quick, straightforward glimpse into how the market values a company’s past or projected earnings. Whether you’re seeking growth stocks or hunting for undervalued gems, the P/E ratio can be your ally—provided you interpret it correctly and supplement it with deeper research.

By mastering the P/E ratio, you add a critical weapon to your investing toolkit. You’ll have greater clarity on when a stock might be overpriced due to hype versus genuinely set for high growth. Conversely, you’ll be better at spotting hidden value plays that others might overlook. So go ahead and start using the P/E ratio in your stock analysis—just remember, it’s not the only metric that matters.

Ready to dive deeper? Explore other valuation tools like the PEG ratio and the Price-to-Book ratio to make even smarter decisions. And if you found this guide helpful, share it with a friend who’s looking to level up their investing game!