Introduction

Traditional IRAs (Individual Retirement Accounts) are popular tax-deferred savings vehicles designed to help individuals grow their retirement funds more efficiently. In this guide, we’ll explore what Traditional IRAs are, how they work, and their potential benefits and drawbacks. We’ll also provide practical steps for opening and managing a Traditional IRA, along with strategies to maximize your retirement savings. By understanding the primary rules, mechanisms, and real-world examples, you can make well-informed decisions that align with your financial goals.

Table of Contents

1. What Is a Traditional IRA?

Definition

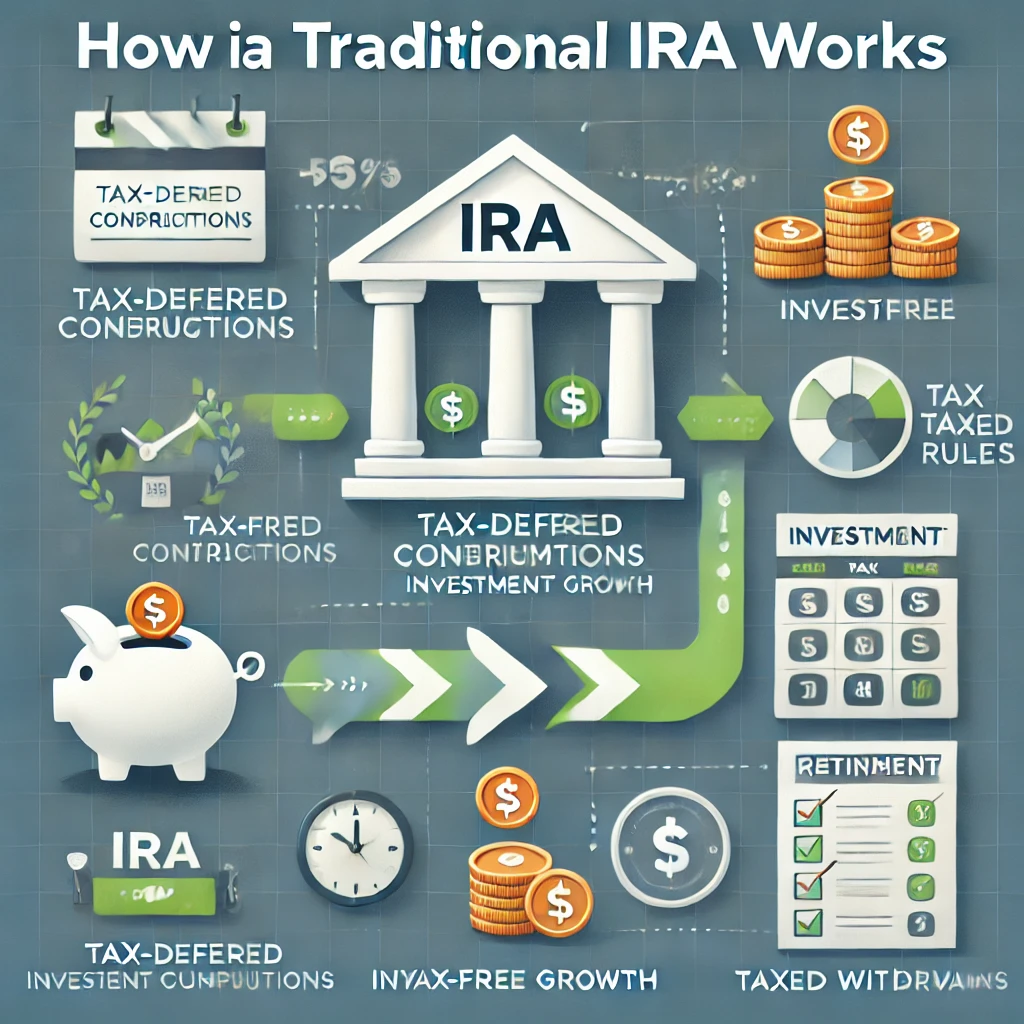

A Traditional IRA is a tax-deferred individual retirement account that allows you to make contributions with pre-tax dollars, reducing your taxable income for the current year. Earnings in the account grow tax-deferred until you withdraw them, typically after reaching retirement age.

Primary Function

- Tax-Deferred Growth: The main benefit is that contributions and investment gains are not taxed until distribution.

- Flexible Investment Options: You can usually choose from stocks, bonds, mutual funds, and more.

- Retirement Security: Designed to encourage long-term saving for retirement.

2. How Does a Traditional IRA Work?

Key Mechanisms

- Contributions: You contribute pre-tax money (subject to annual IRS limits).

- Tax Deferment: Funds grow without being taxed annually.

- Distributions: Withdrawals are taxed as regular income when taken, typically after age 59½.

- Required Minimum Distributions (RMDs): Starting at age 73 (as of the SECURE Act updates), you must withdraw a minimum amount each year.

Important Nuances

- Eligibility: Certain income limits may affect deductibility if you or your spouse is covered by a workplace retirement plan.

- Penalties: Early withdrawals (before 59½) often incur a 10% penalty plus regular income tax, unless certain exceptions apply.

3. Key Features of Traditional IRAs

Main Pros and Cons

Essential Details

- Contribution Limits: Adjusted annually by the IRS (e.g., $6,500/year if under 50; $7,500/year if 50 or older, for 2023).

- Tax Deductibility: Depends on your modified adjusted gross income (MAGI) and workplace retirement coverage.

- Deadline: Contributions for a given tax year can typically be made until the tax filing deadline (around mid-April).

4. How to Get Started with a Traditional IRA

Steps for Opening/Using an Account

- Choose a Provider: Banks, brokerage firms, and robo-advisors offer Traditional IRA accounts.

- Complete Application: Provide personal information (SSN, employment, banking details).

- Fund Your Account: Make a lump-sum deposit or set up recurring contributions.

- Select Investments: Diversify across stocks, bonds, and mutual funds based on your risk tolerance.

- Monitor and Rebalance: Review your portfolio at least annually, adjusting for changes in goals or market conditions.

Rules and Restrictions

- Age Limit: No maximum age limit for contributions if you have earned income (post-2020 rule changes).

- Withdrawal Penalties: 10% penalty for early distributions unless you qualify for exceptions (e.g., first-time homebuyer, certain medical expenses).

Legal and Tax Considerations

- IRS Regulations: Always check the latest guidelines on the IRS website.

- State Taxes: Depending on your state, additional rules may apply.

- Documentation: Keep records of contributions, especially if partially or non-deductible.

5. Examples & Strategies for Using a Traditional IRA

- Max Out Contributions Early

- Contributing the full annual amount at the start of the year maximizes growth potential.

- Consider a Backdoor IRA

- If you exceed income limits for direct contributions to a Roth IRA, you could contribute to a Traditional IRA and then convert to a Roth (consult a tax professional for details).

- Combine with Employer Plans

- If your employer offers a 401(k), consider using both a 401(k) and a Traditional IRA for increased tax-deferred contributions.

- Automatic Contributions

- Set up an automatic monthly transfer to ensure consistency and take advantage of dollar-cost averaging.

Common Questions (FAQ) About 401(k) Plans

Q1: Can I contribute to both a Traditional IRA and a Roth IRA in the same year?

A1: Yes, you can contribute to both as long as your total contributions do not exceed the IRS limit across all IRAs for that year.

Q2: When must I start taking Required Minimum Distributions (RMDs)?

A2: You generally must begin taking RMDs at age 73 (based on recent legislation), though previous rules required age 70½. Check the IRS RMD guidelines for current details.

Q3: Are all contributions fully tax-deductible?

A3: Deductibility can phase out if you or your spouse is covered by a workplace plan and your income exceeds certain thresholds. Consult the IRS guidelines or a tax advisor for specifics.

Q4: What happens if I withdraw money before age 59½?

A4: Early withdrawals may be subject to a 10% penalty and income tax on the distribution, unless you meet specific exceptions like higher education expenses or qualified medical costs.