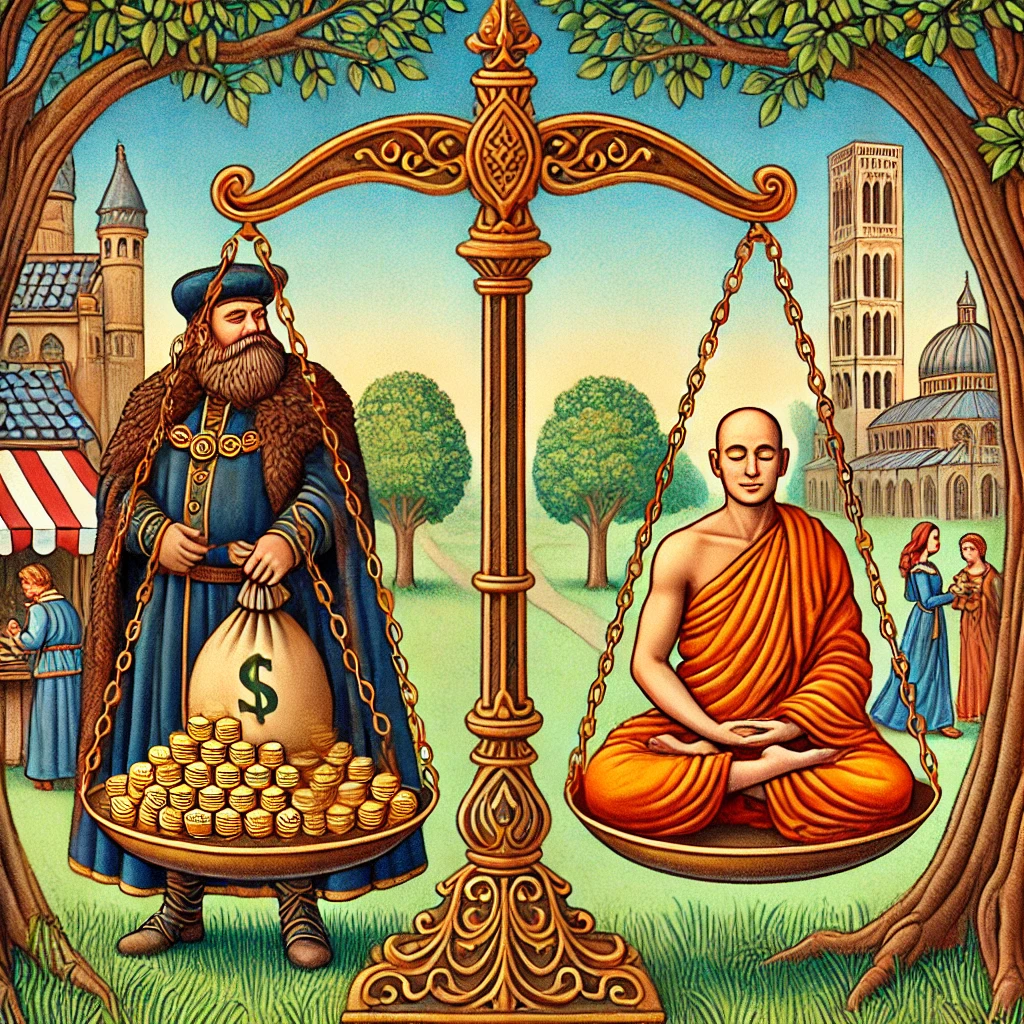

Achieving financial success is a common aspiration. Yet, in the race to reach professional milestones and accumulate wealth, many people find themselves neglecting their health, relationships, and inner happiness. Striking the right balance between financial ambition and personal well-being is crucial for long-term success—both externally and internally. In this comprehensive guide, brought to you by WealthyPot, we’ll explore strategies to ensure your journey toward financial prosperity is as fulfilling and sustainable as possible.

Table of Contents

1. Understanding the Concept of Financial Ambition

Financial ambition is the desire to achieve certain monetary goals—whether that’s earning a six-figure salary, starting a profitable business, or making savvy investments to secure early retirement.

- Healthy Ambition: When financial ambition is driven by personal fulfillment, a desire to contribute to society, or a balanced approach to personal and professional growth.

- Unhealthy Ambition: When the drive for more wealth or status becomes an obsession and overtakes relationships, health, and happiness.

Key Point: Financial ambition, in and of itself, isn’t problematic. It becomes detrimental only when it consumes other equally important areas of life.

2. Why Personal Well-being Matters

Personal well-being encompasses physical health, emotional resilience, mental clarity, and healthy relationships. Without these critical components:

- Physical Health Declines: Chronic stress from relentless money-chasing can lead to insomnia, anxiety, or more serious health issues.

- Mental and Emotional Burnout: Overwork and financial stress can diminish motivation, creativity, and the capacity to enjoy life.

- Strained Relationships: If finances overshadow family, friendship, and community ties, loneliness and emotional isolation often follow.

By nurturing well-being, you increase your potential to perform better, maintain healthy relationships, and enjoy the fruits of your labor for longer.

3. Signs You’re Out of Balance

Not sure whether you’ve tipped too far toward financial goals at the expense of personal well-being? Look for these red flags:

- Constant Stress or Anxiety: Persistent unease about money, job performance, or future finances.

- Neglect of Personal Relationships: Not spending enough time with family and friends or feeling disconnected.

- Physical Symptoms: Frequent headaches, fatigue, or lack of quality sleep.

- Loss of Joy in Daily Activities: Hobbies and leisure feel like a chore instead of a reward.

- Emotional Exhaustion: Feeling numb or burnt out, unable to invest emotionally in anything outside of work or finances.

If you’re experiencing one or more of these signs, it might be time to reassess your priorities and strategies.

4. Practical Strategies to Balance Financial Goals and Well-being

4.1 Define Your Values and Goals

- Reflect on Your Core Values: What truly matters to you—family, creativity, community, or personal growth?

- Align Your Financial Goals: Ensure that your monetary ambitions reflect these core values rather than arbitrary societal benchmarks.

- Create a Clear Roadmap: Set milestones that feel challenging yet achievable. Break large financial goals into smaller targets that integrate seamlessly with your life values.

Example: If family is your priority, aim for a job or business model that allows flexible scheduling. This ensures your financial ambition doesn’t alienate you from loved ones.

4.2 Set Realistic Expectations

Financial success doesn’t usually happen overnight. Managing your expectations is crucial to avoid burnout:

- Avoid Comparison Traps: Everyone’s journey is unique. Comparing your progress to someone else’s can lead to unnecessary stress.

- Pace Yourself: Achieving smaller, incremental goals builds confidence and keeps you motivated.

- Celebrate Milestones: Reward yourself in healthy ways—take a weekend trip or indulge in a favorite activity to acknowledge achievements.

4.3 Practice Mindful Money Management

Mindfulness isn’t just for meditation; it can also inform how you handle your finances:

- Budget with Awareness: Understand your spending patterns and adjust them to reflect your personal priorities.

- Automate Savings: Set up automatic transfers for investments or emergency funds to reduce decision fatigue.

- Invest in Self-Development: Allocate resources to courses or workshops that enhance your skill set, thus improving your potential for higher earnings without sacrificing well-being.

4.4 Prioritize Physical and Mental Health

A healthy body and mind are your most valuable assets:

- Regular Exercise: Even 20 minutes of daily movement can boost energy and reduce stress.

- Mindfulness and Meditation: Brief, consistent meditation sessions can enhance focus, reduce anxiety, and improve emotional well-being.

- Routine Health Checks: Preventive medical visits ensure that health issues are addressed early, minimizing long-term disruptions to both your life and finances.

4.5 Build Meaningful Relationships

Strong personal connections are essential for well-being and resilience:

- Schedule Quality Time: Place family dinners, friend meetups, or community events in your calendar, just like work meetings.

- Communicate Boundaries: Let loved ones know when you need downtime and when you’re available for deeper engagement.

- Seek Support: Share financial pressures and aspirations with those you trust. Open dialogues can provide fresh perspectives and emotional relief.

4.6 Integrate Work-Life Harmony

“Work-life balance” often implies a perfect split, but life is rarely that simple. Work-life harmony suggests a more fluid integration:

- Flexible Scheduling: If possible, talk to your employer or restructure your business for remote or flexible hours.

- Purpose-Driven Work: Align your work or business with a mission that resonates with you personally, so you’re fueled by both ambition and purpose.

- Set Non-Negotiable Personal Time: Keep an evening or weekend day for hobbies, relaxation, or personal projects. Treat it as seriously as you would a work commitment.

4.7 Leverage Technology for Efficiency

Technology can be a powerful ally if used correctly:

- Productivity Tools: Apps for time management, budgeting, and habit tracking can help you stay on course.

- Automate Routine Tasks: Whether it’s paying bills or scheduling social media posts for your business, automation frees up mental bandwidth.

- Digital Detox: Ironically, too much screen time can harm mental health. Schedule digital downtime to recharge emotionally and mentally.

5. Mindset Shifts for Sustained Harmony

Even with the best systems in place, a sustainable balance requires a mindset overhaul. Here are some foundational shifts:

- Scarcity vs. Abundance: Move away from a scarcity mindset. Believe there’s enough opportunity to succeed financially without sacrificing your well-being.

- Growth Mindset: Embrace challenges as opportunities to learn. Failure or setbacks in financial goals shouldn’t derail your sense of self-worth.

- Gratitude Practice: Regularly acknowledge what’s going well. Gratitude can create a positive feedback loop, improving your mental outlook and resilience.

6. Conclusion: Achieving Success from the Inside Out

Balancing financial ambition with personal well-being is not a one-time task but an ongoing journey. By defining your values, setting realistic expectations, prioritizing health and relationships, and adopting a sustainable mindset, you create a life where financial growth complements, rather than competes with, your overall happiness.

Remember, your ultimate goal is holistic success—the kind that feels good on the inside, looks good on the outside, and supports a fulfilling life for years to come.

Ready to elevate your life? Join us at WealthyPot as we continue exploring insights on how to grow your wealth while maintaining the harmony that truly matters.

Thank you for reading! If you found this article valuable, share it with others who might benefit. Let’s build a community where financial ambition meets genuine well-being, one step at a time.