-

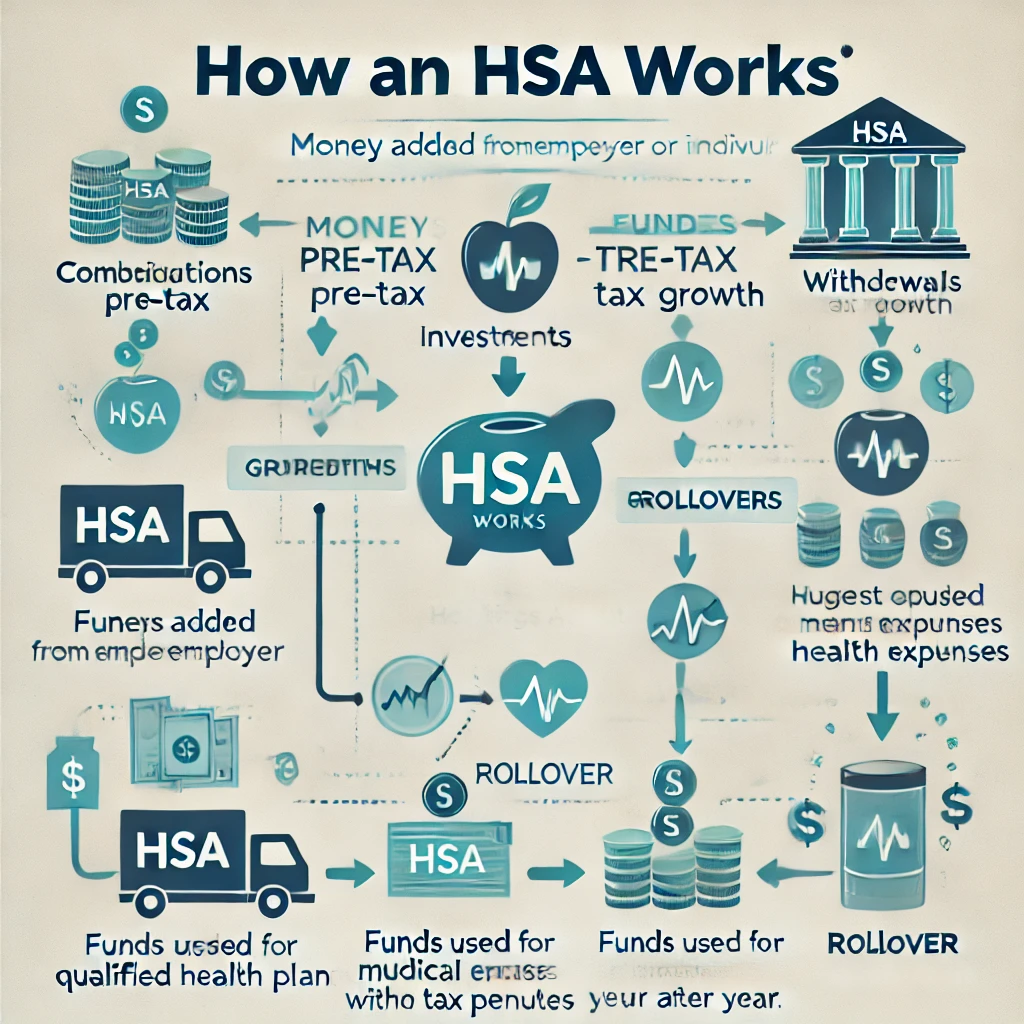

What is a Health Savings Account (HSA)?

A Health Savings Account (HSA) is a tax-advantaged account for medical expenses. Learn what it is, how it works, and the benefits it offers.

-

How to Fix a Broken Budget Mid-Month

Struggling with a broken budget mid-month? Learn 10 powerful strategies to regain control, adjust spending, and stay on track financially.

-

How to Prioritize Financial Goals in Your Budget

Master your budget with smart financial goal prioritization. Learn expert-backed strategies to eliminate debt, grow savings, and secure your future.

-

Smart Steps: Saving for a Home Down Payment in 2025

Saving for a home down payment in 2025? Learn smart, proven strategies to budget, cut costs, and boost savings—turn your dream home into reality!

-

Breaking Money Myths That Hold You Back

Many financial beliefs are actually myths that keep you from building wealth. Learn the biggest money misconceptions and how to break free.

-

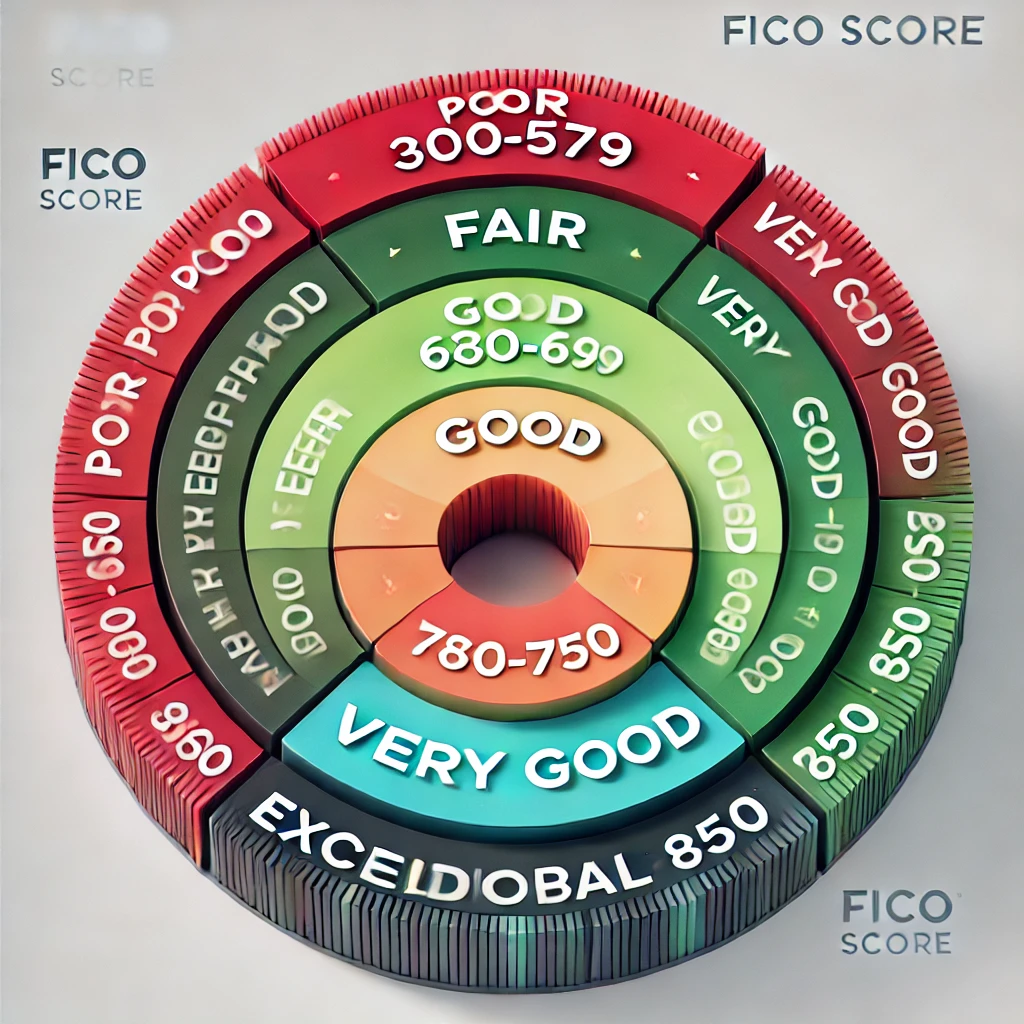

Understanding the FICO Score: Factors That Matter Most

Your FICO score affects loans, interest rates, and credit. Discover the key factors that influence your score and how to improve it.

-

Navigating Market Volatility: Tips for Emotional Control

Market swings can test your patience. Avoid emotional investing mistakes with proven strategies to stay disciplined and protect your portfolio.

-

Building Wealth Slowly: The Power of Steady Contributions

Wealth isn’t built overnight. Consistent investing and compounding can turn small contributions into a fortune. Here’s how to stay the course.

-

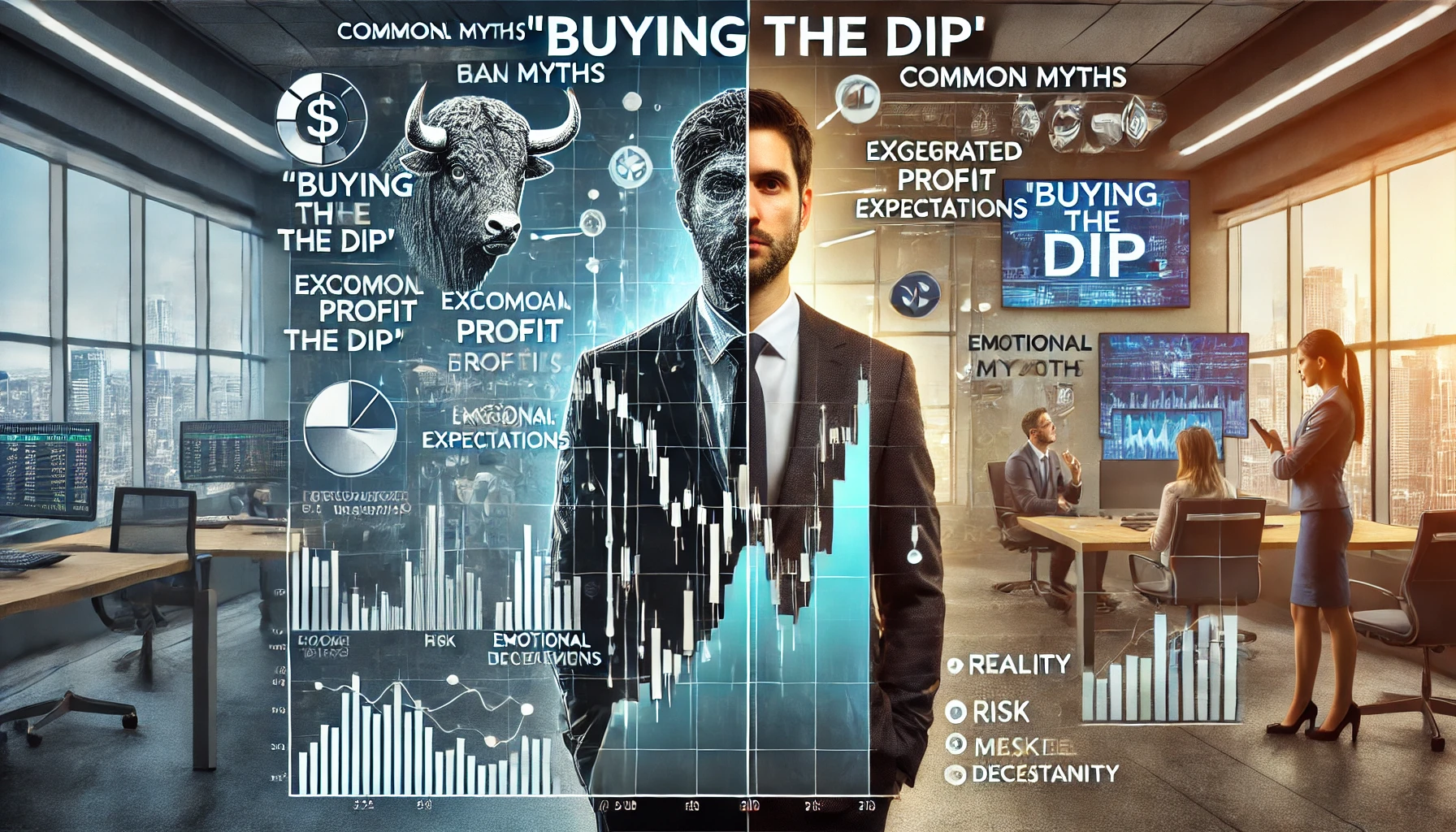

The Psychology of Buying the Dip: Myths vs. Reality

“Buy the dip” sounds great, but does it always work? Learn the psychological traps and smart strategies for buying low without losing big.

-

Building an Emergency Fund Before You Invest: Why It Matters

Investing is key to wealth, but without an emergency fund, you’re at risk. Learn why having cash reserves is essential before entering the market.

-

How to Assess Risk Tolerance Before Investing

Investing isn’t one-size-fits-all. Learn how to determine your personal risk tolerance and build a portfolio that aligns with your goals.

-

Staying Flexible: Adjusting Your Budget in Real-Time

Life is unpredictable, and so is your budget. Learn how to stay financially flexible, adjust spending, and adapt to unexpected expenses.

Categories

- Advanced Investing

- Budgeting & Money Management

- Credit Building & Management

- Cryptocurrency & Blockchain

- Debt Management

- Financial Education & Mindset

- Income Generation

- Insurance & Risk Management

- Investing Basics

- Real Estate & Alternative Investments

- Retirement Planning

- Saving Strategies

- Tax Planning