-

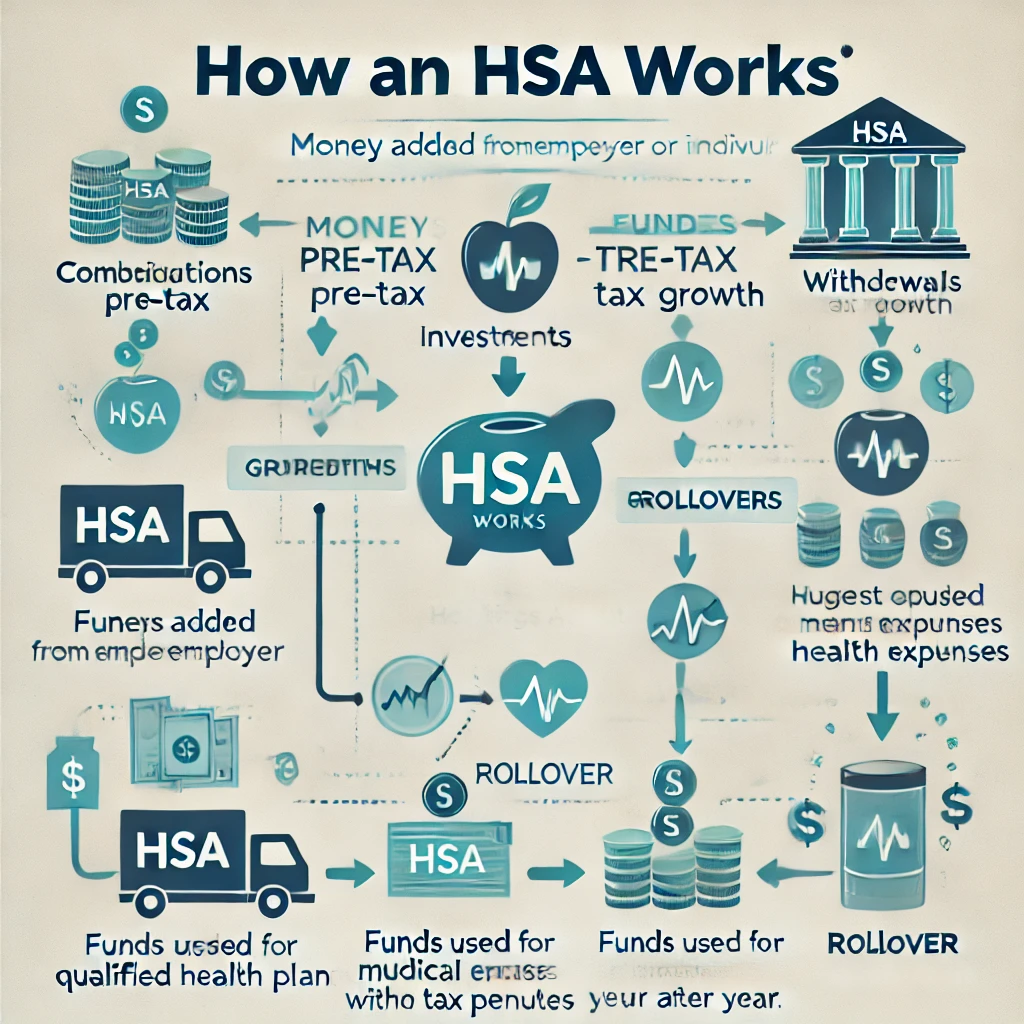

What is a Health Savings Account (HSA)?

A Health Savings Account (HSA) is a tax-advantaged account for medical expenses. Learn what it is, how it works, and the benefits it offers.

-

Tax Brackets Explained: Where Does Your Income Fall?

Understanding tax brackets can help you legally lower your tax bill. Learn how they work and what strategies can help you keep more of your income.

-

How to Handle Taxes on Cryptocurrency Investments

Learn how crypto taxes work, what to report, and strategies to minimize tax liabilities while staying compliant.

-

How to Prepare for Tax Season: A Comprehensive Checklist

Stay ahead this tax season with a step-by-step checklist to organize finances, maximize deductions, and file smoothly.

-

Tax Planning Tips for Freelancers and Self-Employed Individuals

Discover essential tax strategies for freelancers and self-employed professionals to reduce tax burdens and optimize earnings.

-

How to Use Tax-Advantaged Accounts to Grow Wealth

Boost your savings and wealth-building efforts by leveraging tax-advantaged accounts like IRAs, 401(k)s, and HSAs.

-

The Impact of New Tax Laws on Your Personal Finances

Stay informed about recent tax law changes and how they affect your income, deductions, and overall financial planning.

-

Understanding Capital Gains Tax and How to Minimize It

Learn how capital gains tax works and discover smart strategies to reduce your tax burden on investments.

-

How to Maximize Deductions for Home Office Expenses

Unlock tax savings by properly deducting home office expenses and ensuring compliance with IRS rules.

-

Tax-Efficient Investing Strategies for 2025

Optimize your investment returns by using tax-efficient strategies to minimize liabilities and grow your wealth.

-

Strategies to Reduce Your Tax Liability Legally

Discover legal tax-saving strategies to minimize your liabilities and keep more of your hard-earned money.

-

How to Utilize Tax-Loss Harvesting to Optimize Returns

Reduce your tax burden and maximize investment returns with tax-loss harvesting strategies.

Categories

- Advanced Investing

- Budgeting & Money Management

- Credit Building & Management

- Cryptocurrency & Blockchain

- Debt Management

- Financial Education & Mindset

- Income Generation

- Insurance & Risk Management

- Investing Basics

- Real Estate & Alternative Investments

- Retirement Planning

- Saving Strategies

- Tax Planning

Tax Planning Tips & Insights

Minimize liabilities and keep more of your hard-earned money with strategic tax planning. In this category, we explore the latest deductions, credits, and tax-advantaged accounts available to individuals, freelancers, and business owners. Learn how to prepare for filing season, organize essential documents, and navigate ever-changing tax laws with confidence. Whether you’re optimizing your retirement accounts or running a small business, discover clear, actionable tips to reduce your tax burden