Credit utilization is one of the most critical yet frequently misunderstood factors in personal finance. Whether you’re working toward improving your credit score or simply want to maintain a healthy financial profile, optimizing your credit utilization ratio plays a significant role. In this comprehensive guide, we’ll break down what credit utilization means, why it matters, and how you can leverage strategies to keep it in the optimal range.

Table of Contents

What Is Credit Utilization?

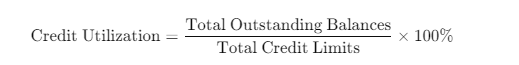

Credit utilization refers to the percentage of your total available credit that you’re currently using. For example, if you have a credit card with a $1,000 limit and a $300 balance, your utilization for that card is 30%. The same concept applies across all your credit accounts combined.

- Formula:

A lower utilization ratio generally signals to creditors that you manage debt responsibly, which in turn can enhance your creditworthiness.

Why Does Credit Utilization Matter?

Your credit utilization ratio is a key factor in FICO and other credit scoring models. In many cases, it can account for about 30% of your overall credit score. Here are some of the main reasons it’s crucial:

- Creditworthiness: Lenders use this ratio to gauge how well you handle borrowed money.

- Interest Costs: High utilization often leads to higher interest payments if you’re carrying a balance month to month.

- Loan Approvals: When banks or mortgage lenders see a low utilization ratio, they’re more likely to offer favorable loan terms.

Optimal Credit Utilization Range

While the ideal credit utilization ratio can vary depending on who you ask, many financial experts recommend keeping it below 30%. If you’re aiming for top-tier credit scores, some suggest staying under 10% for maximum benefit. Balancing between these ranges typically demonstrates responsible credit management.

Example:

- If your total credit limit across all cards is $10,000, try to keep your total balance under $3,000 for a sub-30% utilization, or under $1,000 for closer to 10%.

Common Misconceptions

- You Must Carry a Balance for a Good Score

Some people believe that you have to carry a balance from month to month. In reality, paying off your balance in full can be beneficial, especially if you keep your utilization below or around 10%. - Closing Old Cards Always Helps

Closing an old credit card might reduce your overall credit limit, which can inadvertently increase your utilization ratio, even if your debt hasn’t changed. - Credit Utilization Is the Only Factor

Although critical, utilization isn’t the sole determinant. Payment history, credit age, and credit mix also significantly impact your score.

Practical Ways to Optimize Your Credit Utilization

- Request a Credit Limit Increase

Boosting your credit limit can help lower your utilization ratio—provided you don’t accumulate higher balances.- Tip: Call or go online to your card issuer’s portal and request an increase. Be prepared to explain why you deserve it (e.g., improved income, consistent on-time payments).

- Pay Balances Early or More Than Once a Month

Your credit card statement only reflects the balance at the close of your billing cycle. Paying off portions of your balance before the statement cuts can lower your reported utilization.- Example: If you have a $2,000 balance and can afford to pay $1,500 mid-cycle, only $500 will appear on your statement.

- Distribute Your Debt

Rather than maxing out a single card, spread your balances across multiple cards. This approach helps prevent any single account from showing a very high utilization rate. - Use Balance Transfer Options Wisely

A 0% APR balance transfer card can help you consolidate debt and reduce interest costs. It also ensures that you don’t max out a single card, keeping your ratio balanced. - Keep Old Cards Open

Even if you rarely use them, old cards increase your total available credit and lower your average balance-to-limit ratio. Just make sure to watch out for any annual fees. - Monitor Your Credit Regularly

Use free credit monitoring tools or paid services to track your utilization. Early detection of any spikes in usage allows you to take corrective action quickly.

Additional Tips to Strengthen Your Financial Standing

- Automate Your Payments: Late payments can tank your credit score faster than a moderate utilization ratio. Set up automatic payments or reminders.

- Build an Emergency Fund: Having savings on hand can reduce the need to rely on credit, thus keeping your utilization low.

- Diversify Your Credit Mix: Show lenders you can manage different types of credit (like installment loans, revolving credit) responsibly.

Potential Pitfalls to Avoid

- Relying on One Strategy Alone: Combine different tactics (e.g., limit increases, debt distribution) for best results.

- Ignoring Other Credit Factors: A strong credit score also depends on on-time payments, credit age, and having a healthy mix of credit accounts.

- Not Checking Reports: Errors in your credit report could inflate your utilization ratio; review your credit reports at least once a year.

How Often Should You Check Your Credit Utilization?

Credit utilization can fluctuate from month to month. A best practice is to check it at least once per billing cycle. If you’re aggressively working to improve your score, consider weekly or biweekly checks through a free credit monitoring service. By staying proactive, you can quickly identify any unusual charges or reporting errors.

Frequently Asked Questions

Q: Do I need multiple credit cards to maintain a low utilization ratio?

A: Not necessarily. Having one or two credit cards used responsibly can be enough. However, more cards do provide higher overall credit limits, which can help keep your utilization lower—provided you manage each account well.

Q: Will paying off my balance in full hurt my credit score?

A: Paying off your balance in full typically helps your score. It demonstrates responsible usage and prevents interest charges from accruing.

Q: How quickly can lowering my utilization improve my credit score?

A: Changes in utilization can reflect on your credit score as soon as issuers report updated balances, generally every 30 days. You could see positive results in as little as one to two billing cycles.

The Bottom Line

Lowering your credit utilization ratio is one of the most effective ways to strengthen your credit profile. By understanding the mechanics of credit utilization—what it is, how it’s calculated, and why it matters—you equip yourself with the knowledge to make impactful financial decisions. From requesting credit limit increases to distributing balances across different accounts, there are multiple tactics to keep your utilization ratio in check.

A healthy credit utilization not only boosts your credit score but also opens doors to better interest rates, loan approvals, and overall financial well-being. Whether you’re just starting your credit journey or looking to refine your existing strategies, consistent monitoring and responsible usage will keep you on the path to success.

Pro Tip: Remember that credit utilization is just one aspect of your credit health. Combine the strategies above with on-time payments, a solid credit mix, and regular credit report reviews to truly optimize your financial future.

Ready to take your credit profile to the next level?

Stay tuned to WealthyPot.com for more tips on budgeting, investing, and building long-term financial security. Share this guide with friends or family who need a credit boost—together, we can all achieve a brighter financial future!