Introduction

Investors often find themselves torn between Exchange-Traded Funds (ETFs) and Mutual Funds when building or diversifying a portfolio. Both offer diversified exposure, professional management (to varying degrees), and a pathway to achieving your long-term financial goals. However, each has specific features, cost structures, and tax implications that may make one more suitable than the other. In this article, we’ll explore the key differences, advantages, and drawbacks of ETFs and Mutual Funds, helping you choose the investment vehicle that best aligns with your objectives.

What Are ETFs?

Exchange-Traded Funds (ETFs) are funds that track a particular index, sector, commodity, or basket of assets and trade on an exchange like individual stocks.

- Intraday Trading: ETFs can be bought or sold any time the market is open.

- Passive Management: The majority of ETFs aim to replicate the performance of a particular index (e.g., the S&P 500).

- Lower Expense Ratios: ETFs typically have lower expense ratios compared to many actively managed mutual funds.

- Tax Efficiency: Their structure often minimizes taxable events because of in-kind redemptions.

Keywords: ETFs, intraday trading, passive investing, tax efficiency

Example: An S&P 500 ETF holds shares in the top 500 U.S. companies by market capitalization. If Apple’s weighting in the index changes, the ETF automatically adjusts its holdings to replicate that shift.

What Are Mutual Funds?

Mutual Funds pool money from multiple investors to invest in a portfolio of securities—such as stocks, bonds, or other assets.

- End-of-Day Trading: Mutual fund transactions (buy or sell) are executed at the end of the trading day at the fund’s net asset value (NAV).

- Active Management: Many mutual funds are actively managed, aiming to outperform an index through stock selection and other strategies.

- Automatic Investing: Ideal for investors who prefer systematic investment plans (SIPs) or regular contributions.

- Possible Minimum Investment: Some mutual funds require a specific minimum contribution (e.g., $1,000 or $2,500).

Keywords: Mutual funds, active management, end-of-day trading, systematic investment plans

Example: A Growth Fund might focus on stocks with higher growth potential. The fund manager actively adjusts the portfolio based on market research and economic forecasts.

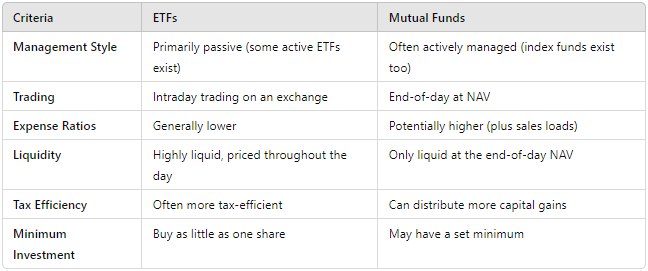

Key Differences at a Glance

Understanding Costs and Fees

Expense Ratios

- ETFs: Typically feature lower expense ratios, making them highly cost-effective for buy-and-hold investors.

- Mutual Funds: Actively managed mutual funds often charge higher expense ratios to cover research, management, and distribution fees (e.g., 12b-1 fees).

Sales Loads and Commissions

- ETFs: You’ll pay a brokerage commission or fee each time you buy or sell. However, many brokerages now offer commission-free ETF trades.

- Mutual Funds: Some include front-end loads or back-end loads—fees paid either when buying (A-share class) or selling (B-share class) shares.

Pro Tip: Always review the prospectus to understand total fees, whether you’re looking at an ETF or a mutual fund.

Tax Efficiency Considerations

One of the major differentiators that surfaces high on Google search results is tax efficiency.

- ETFs: Due to the “in-kind” creation and redemption process, ETFs distribute fewer capital gains. This advantage is particularly notable in taxable accounts.

- Mutual Funds: Capital gains are distributed to shareholders, often triggered when a fund manager sells securities at a profit within the portfolio.

Keywords: tax efficiency, capital gains distributions, in-kind redemption, taxable accounts

When to Choose ETFs

- You Prefer Passive Investing

If your goal is to track market performance at a lower cost rather than beat it, a broad-market ETF (like an index ETF) may be a perfect fit. - You Value Intraday Liquidity

Traders or short-term investors who want to capitalize on market movements throughout the day will favor ETFs. - You’re Tax-Sensitive

If you’re looking to minimize taxable events in a non-retirement (taxable) account, ETFs often have the upper hand.

When to Choose Mutual Funds

- You Want Professional Management

Actively managed mutual funds aim to outperform market benchmarks. For investors seeking alpha, mutual funds with skilled managers might be worth the higher fees. - You Use Automatic Contribution Plans

Mutual funds are well-suited for systematic investment programs (e.g., monthly contributions), which can help maintain consistent saving habits. - You’re Comfortable with End-of-Day Pricing

If frequent intraday price changes don’t matter to you, and you trust the manager to allocate assets wisely, mutual funds might be more convenient.

Combining ETFs and Mutual Funds

Many top-ranking articles suggest building a hybrid portfolio that includes both ETFs and mutual funds. This approach lets you leverage the tax benefits and lower costs of ETFs for your core holdings, while strategically using actively managed mutual funds for specific sectors, thematic investments, or specialized markets.

Example:

- Core Holdings (70%): Broad-market ETFs for U.S. large-cap, international, and bond exposure.

- Satellite Holdings (30%): Actively managed mutual funds focusing on emerging markets or specific sectors (e.g., biotech) where you believe active managers may add value.

Practical Checklist: Deciding Between ETFs and Mutual Funds

- Investment Goals

- Long-term wealth building, retirement, short-term trading, or something else?

- Risk Tolerance

- Are you comfortable with market volatility, or do you prefer less fluctuation?

- Cost Sensitivity

- Are expense ratios, loads, or transaction fees a major concern?

- Tax Implications

- Trading Style

- Do you want the flexibility to buy or sell midday, or is end-of-day pricing sufficient?

Tip: Fill out a cost-and-fee calculator to compare real costs over time. Small percentage differences in expense ratios can significantly affect returns when compounded over many years.

Download Etf Vs Mutual Checklist

Example Scenarios

- Young Investor Starting Out

- Why ETFs? Lower cost, easy to diversify across major indices, and minimal capital gains distributions.

- Retiree Seeking Steady Income

- Why Mutual Funds? Certain income-focused mutual funds or bond funds managed by professionals can provide structured payouts.

- Active Trader with a Strong Market Outlook

- Why ETFs? Intraday trading allows you to make quick market plays or hedge existing positions.

- Long-Term Growth Seeker

- Why Mutual Funds? An actively managed growth fund might surpass index returns—especially if managed by a well-regarded portfolio manager.

Conclusion

Both ETFs and Mutual Funds play integral roles in modern investing. ETFs generally offer lower costs, intraday liquidity, and tax efficiency, making them a strong choice for passive or cost-conscious investors. Mutual funds, on the other hand, can excel for active management, systematic contributions, and specialized market segments. Ultimately, your selection should hinge on your investment timeline, risk tolerance, and personal preferences for cost and convenience. Don’t overlook the possibility of combining both to build a diversified portfolio that checks all the right boxes.