A Health Savings Account (HSA) is a tax-advantaged medical savings account available to individuals enrolled in a High-Deductible Health Plan (HDHP). According to the IRS official guidelines, you can contribute pre-tax dollars to cover eligible healthcare expenses, ranging from routine doctor visits to prescription medications.

Table of Contents

Definition

Think of an HSA as a personal savings account specifically designed for medical costs. Funds contributed are not subject to federal income tax at the time of deposit.

Primary Function

Its primary function is to help individuals manage current and future healthcare expenses. By allowing tax-free contributions and withdrawals (for qualified medical expenses), an HSA reduces the overall cost of healthcare and can also serve as a long-term investment vehicle.

How Does a Health Savings Account (HSA) Work?

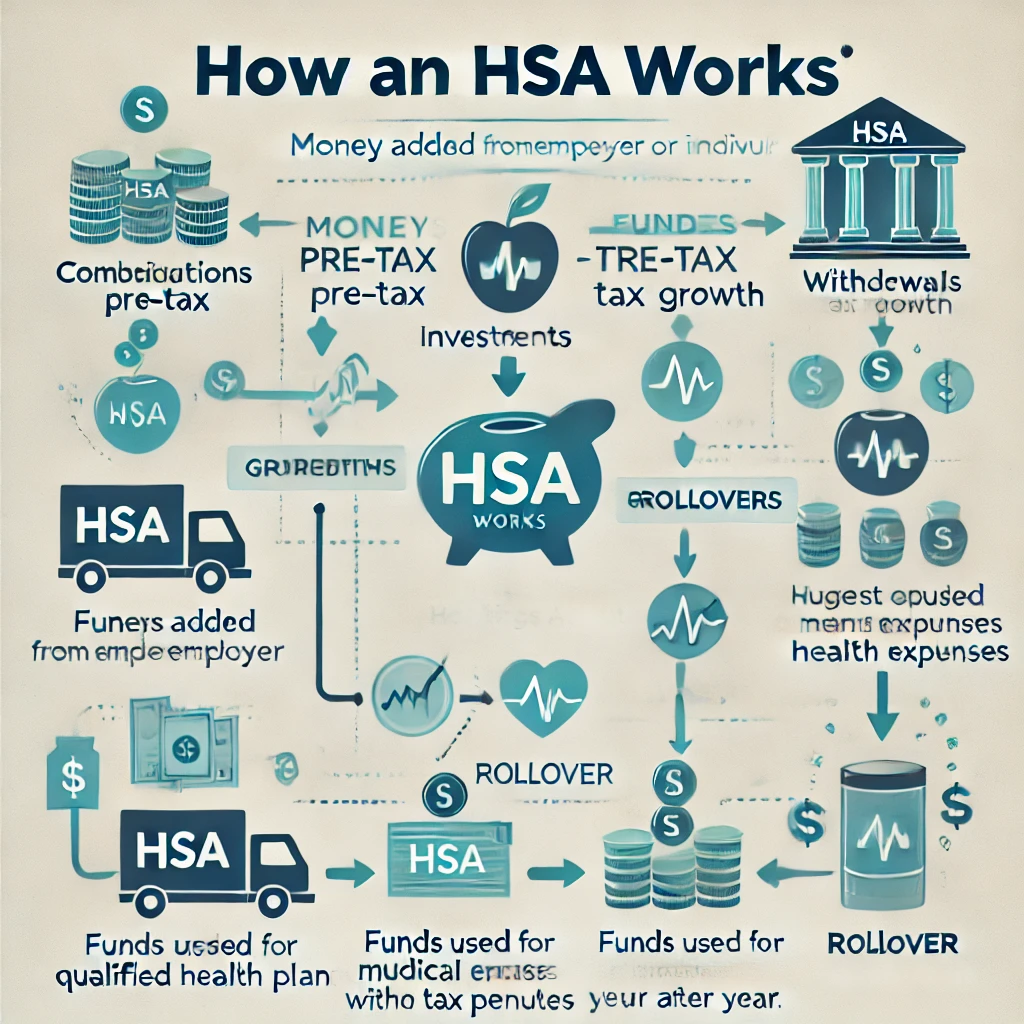

Key Mechanisms

- Eligibility: You must be enrolled in a High-Deductible Health Plan (HDHP) to contribute to an HSA.

- Contributions: Contributions can be made by you, your employer, or both. These deposits are typically exempt from federal taxes.

- Withdrawals: When you use HSA funds for qualified medical expenses (e.g., doctor appointments, prescription drugs), the withdrawals remain tax-free.

Important Nuances

- Contribution Limits: The IRS sets annual limits on how much you or your employer can contribute. For example, in 2023, the limit was $3,850 for individuals and $7,750 for families (check the IRS website for the latest figures).

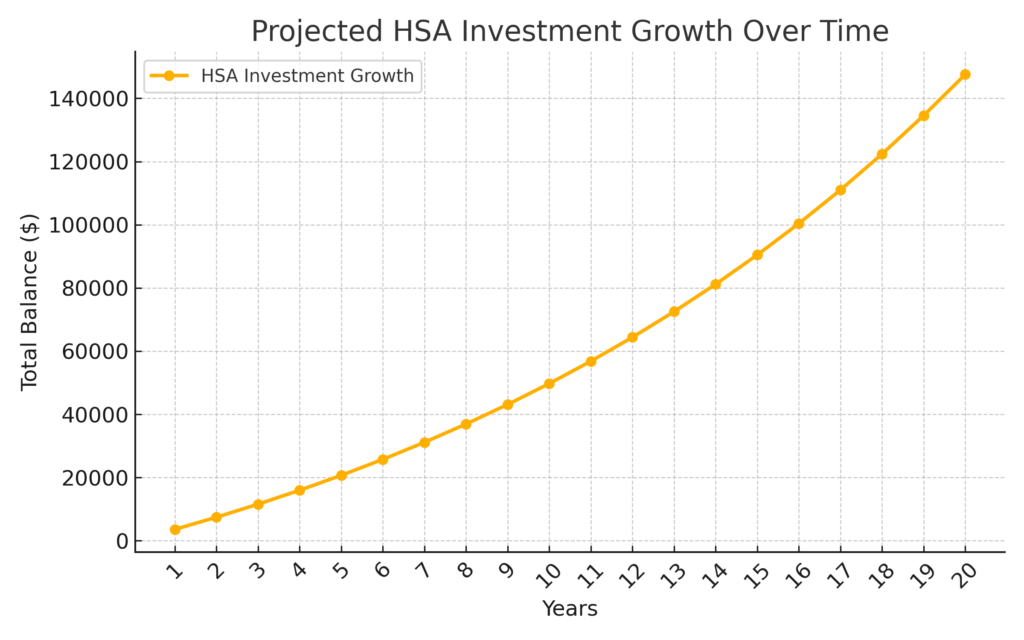

- Investment Opportunities: Many HSA providers allow you to invest a portion of your balance into stocks or mutual funds for potential long-term growth (similar to 401(k) or IRA accounts).

Key Features of a Health Savings Account (HSA)

Main Pros and Cons

Below is a comparison of key HSA features, highlighting their advantages and possible drawbacks:

Essential Details

- Portability: Unlike a Flexible Spending Account (FSA), your HSA funds remain with you indefinitely; they don’t expire at the end of the year.

- No “Use-It-or-Lose-It”: You can let the balance grow over time, earning interest or investment returns.

How to Get Started with a Health Savings Account (HSA)?

Steps for Opening/Using an Account

- Enroll in an HDHP: Confirm your insurance plan meets the IRS definition of a High-Deductible Health Plan.

- Choose an HSA Provider: Many banks and financial institutions offer HSA accounts. Compare fees, investment options, and digital tools.

- Fund Your Account: Contribute via payroll deductions or direct deposits. Some employers also contribute a portion to your HSA.

- Use Your Funds: Pay for qualified medical expenses using your HSA debit card or reimbursement process.

Rules and Restrictions

- You must not be enrolled in Medicare or claimed as a dependent on someone else’s tax return.

- Contributions can only be made when you meet eligibility criteria.

Legal and Tax Considerations

- Contributions are tax-deductible up to IRS limits.

- Withdrawals for non-qualified expenses may incur taxes and penalties before age 65.

Examples & Strategies for Using a Health Savings Account (HSA)

Best Practices for Maximum Benefit

- Contribute the Maximum Amount: Maximize tax savings by reaching the annual limit.

- Invest Excess Funds: After building a comfortable cash reserve, consider investing in mutual funds or other eligible assets for long-term growth.

- Keep Receipts: Maintain records of all medical expenses to prove they are qualified under IRS regulations.

- Pair with Retirement Planning: After age 65, HSA funds can be used for non-medical expenses without penalty (though they will be taxed as regular income).

Frequently Asked Questions (FAQ)

Q1: What happens to my HSA if I switch jobs?

Your HSA is portable. You own the account, so you can take it with you even if you change employers or health insurance providers.

Q2: Can I use HSA funds for my spouse or children?

Yes, you can generally use your HSA for eligible medical expenses for your spouse or dependents, even if they are not covered under your HDHP.

Q3: What if I use HSA funds for non-medical expenses?

If you are under 65, such withdrawals are subject to income tax and a 20% penalty. After 65, non-medical withdrawals are taxed as income without penalty.

Q4: Can my HSA balance earn interest?

Yes. Most HSA providers offer interest-bearing accounts, and some even allow you to invest in mutual funds, stocks, or bonds once you meet a minimum balance threshold.