Budgeting is one of the most powerful tools for achieving financial stability and building long-term wealth. Yet, many people struggle with deciding which financial goals to focus on first. Should you tackle debt, boost your emergency fund, invest for retirement, or save for big-ticket items like a car or a home? Understanding how to prioritize financial goals in your budget is the key to making consistent progress toward the life you envision.

Below, you will discover expert strategies for setting clear objectives, allocating resources wisely, and continuously adapting your plan as your circumstances change. By the end of this guide, you will be equipped with a strong framework to confidently align your budget with your most important financial goals.

Understanding the Importance of Financial Goals

Financial goals act as the roadmap to your overall financial health. They give structure and purpose to how you manage your money. Without specific targets—like saving for a down payment or paying off student loans—budgeting often becomes a disorganized exercise of merely tracking expenses.

- Clarity and Motivation

When you have well-defined goals, each budget category feels purposeful rather than restrictive. You understand the “why” behind the spending limits. - Accountability

Goals make it easier to track your progress and hold yourself accountable. You can see where your money is going and quickly adjust if you’re veering off-track. - Long-Term Vision

Day-to-day expenses can overshadow future needs. Prioritizing financial goals ensures that your long-term well-being—such as retirement or your children’s education—remains at the forefront.

Types of Financial Goals

Financial objectives typically fall into three broad categories: short-term, mid-term, and long-term. Each category serves a specific purpose, and understanding these will help you distribute funds more effectively within your budget.

Short-Term Goals (Up to 1 Year)

Short-term goals usually involve immediate or near-future needs.

- Examples: Building a starter emergency fund, saving for a vacation, covering holiday gifts, or tackling small high-interest debts.

- Why They Matter: Quick wins can be motivating. Achieving short-term objectives builds confidence and momentum.

Mid-Term Goals (1 to 5 Years)

Mid-term goals have a slightly longer horizon.

- Examples: A down payment on a house, funding career development courses, or saving for a family event like a wedding.

- Why They Matter: These goals often require consistent monthly contributions. Balancing them with short-term priorities and everyday expenses can be challenging but highly rewarding.

Long-Term Goals (5+ Years)

Long-term goals lay the foundation for financial security and future freedom.

- Examples: Retirement savings, long-term investments, and establishing a college fund.

- Why They Matter: The earlier you start, the stronger your financial footing in later life. Compounding interest and time can dramatically boost your returns.

Evaluating Your Current Financial Situation

Before you start allocating funds to specific goals, you must assess your overall financial standing. A clear picture of your income, debts, and regular expenses sets the stage for more effective prioritization.

- Calculate Your Monthly Net Income

- Include all sources of income: salary, side hustles, and passive earnings.

- Focus on the amount that actually lands in your bank account after taxes and deductions.

- List Your Expenses

- Separate essential expenses (rent/mortgage, utilities, groceries, transportation) from discretionary expenses (entertainment, dining out).

- This helps identify areas where you can cut back to redirect funds toward your financial goals.

- Determine Your Net Worth

- Assets: Checking and savings accounts, retirement funds, property, and any other valuable possessions.

- Liabilities: Mortgages, student loans, credit card balances, and other debts.

- Subtract your liabilities from your assets to find your net worth. This number gives you a “big picture” sense of financial health.

- Review Your Credit Score

- A strong credit score can lower the cost of borrowing for larger goals.

- Check if there are errors or areas you can improve (such as paying down high-interest debt).

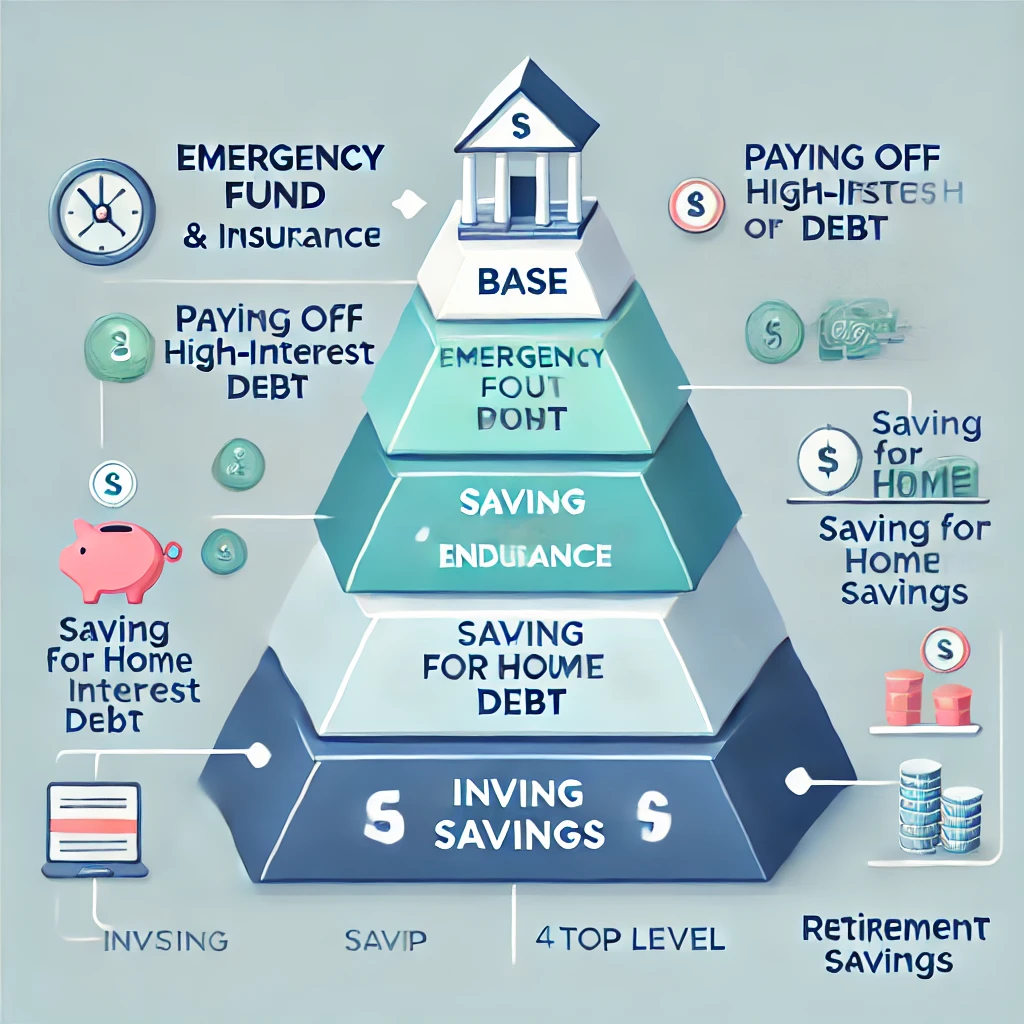

Creating a Hierarchy of Financial Goals

Not all financial goals carry the same weight. Some are urgent, while others can wait. Creating a hierarchy ensures you allocate funds to the goals that matter most.

- Immediate Safety Goals

- Emergency Fund: Aim for at least three to six months’ worth of living expenses in a liquid, easily accessible account. This safety net prevents financial setbacks from spiraling into bigger problems.

- Essential Insurance: Life, health, and property insurance protect you against catastrophic losses.

- High-Priority Goals

- Debt Repayment: Focus on high-interest debt first (e.g., credit cards, payday loans). The faster you clear these, the more money you free up for savings and investments.

- Retirement Savings: Contribute to a 401(k) or IRA, especially if your employer offers a match. Time is a crucial factor in building a robust retirement fund.

- Medium-Priority Goals

- Homeownership: If buying a home is a priority, start saving for a down payment and closing costs.

- Education Funds: For yourself or your children, depending on your life stage and goals.

- Lower-Priority Goals

- Lifestyle Upgrades: Vacations, nicer cars, or non-essential hobbies typically come after you have stable savings and moderate to low debt.

- Speculative Investments: High-risk, high-reward opportunities should only be considered if you have a solid financial foundation.

Allocating Your Budget According to Priorities

Once you have a clear hierarchy, it’s time to map your money to each goal. The exact percentage you allocate will vary based on your income, cost of living, and personal preferences.

- Consider a Budgeting Framework

- 50/30/20 Rule: 50% of your net income for essentials, 30% for wants, 20% for savings/debt repayment. Modify the percentages as needed, especially if you have aggressive financial goals.

- Zero-Based Budgeting: Assign every dollar a specific task (e.g., rent, groceries, savings, debt). This method requires thorough planning and discipline but can yield excellent results.

- Automate Where Possible

- Set up automatic transfers for savings and debt payments.

- Automation reduces the temptation to spend money you intended to save.

- Track Discretionary Spending

- Apps and expense trackers can keep you aware of how much you spend on non-essentials.

- If you exceed your discretionary limit, it’s a cue to reassess your spending patterns.

- Revisit and Adjust

- Monthly Reviews: Compare actual spending to your budget. Adjust allocations as needed to stay aligned with your goals.

- Life Changes: Major events like marriage, relocation, or job changes can require a budget overhaul.

Sample Budget Categories and Recommended Allocation

Below is an example of how you might allocate funds toward different financial goals. The percentages are not one-size-fits-all but provide a starting framework:

Maintaining Momentum and Motivation

Budgeting is not merely about limiting your outflow; it’s a strategy to allocate your resources to what truly matters to you. Maintaining motivation over the long haul can be challenging, so consider these techniques:

- Visual Reminders

Post a photo that represents your primary goal—be it a new home, a dream vacation, or a debt-free life—somewhere you can see it daily. - Celebrate Milestones

When you pay off a debt or hit a savings milestone, treat yourself to something modest yet meaningful. This positive reinforcement builds excitement for the next goal. - Stay Educated

Financial literacy goes a long way in helping you make informed decisions. Read books, blogs, and articles on personal finance to stay updated with new strategies and insights. - Leverage Accountability

- Consider working with a financial planner if you need extra guidance.

- Join online communities or find a budgeting buddy to share progress and tips.

Common Mistakes to Avoid

- Ignoring an Emergency Fund

Skipping this step can lead to spiraling debt if an unexpected expense arises. - Underestimating Monthly Expenses

Poor tracking of groceries, utilities, or subscriptions can throw off your entire plan. - Focusing Solely on Debt

While it’s crucial to eliminate high-interest debt, neglecting long-term savings can hurt you in the long run. - Overcommitting to Savings

If you allocate too much to savings without leaving room for fun or unplanned events, you may burn out and revert to old spending habits. - Failing to Reassess and Reprioritize

Life changes—big or small—can quickly shift your financial focus. Regularly review and adjust your budget.

Long-Term Growth Strategies

- Diversify Your Investments

Once you’re steadily contributing to retirement accounts and have minimal consumer debt, explore avenues like index funds, real estate, or bonds to diversify risk. - Build Multiple Income Streams

A side hustle, investment property, or freelance work can supplement your primary salary, speeding up your progress on multiple financial goals. - Plan for Major Life Events

Whether it’s marriage, children, or a career change, these can significantly affect your budget and savings. Early planning helps you stay financially stable during transitions. - Protect What You Build

- Estate Planning: Draft a will, especially if you have dependents or significant assets.

- Insurance: Continuously review coverage to match your financial situation and risk profile.

Staying Flexible in Your Priorities

Financial planning is dynamic. As you move through different stages of life, your priorities will evolve. Keep your plan flexible enough to accommodate these shifts without derailing your long-term objectives.

- Adapt to Economic Changes: Changes in interest rates or market conditions may require adjustments in your investment or debt repayment strategies.

- Regular Goal Check-Ins: At least twice a year, revisit your short-, mid-, and long-term goals to see if they still align with your life plans.

- Adjust for Income Growth: If you receive raises or bonuses, consider increasing your savings and investment percentages alongside your lifestyle upgrades.

Conclusion: Achieving Financial Success Through Priority Budgeting

Figuring out how to prioritize financial goals in your budget requires thoughtful analysis, consistent tracking, and the ability to adapt. By evaluating your current financial status, setting clear short-term, mid-term, and long-term goals, and allocating resources according to a well-defined hierarchy, you create a realistic and motivating plan.

Remember to celebrate milestones and stay flexible as your circumstances change. With discipline and clarity, you’ll turn your budget into a powerful tool that steadily drives you toward financial freedom and security.

EXTERNAL LINKS

- Consumer Financial Protection Bureau: https://www.consumerfinance.gov/

- Investor.gov: https://www.investor.gov/

- National Endowment for Financial Education: https://www.nefe.org/