Your FICO score is more than just a number—it’s a key that can unlock a wide range of financial opportunities. Whether you’re buying a house, financing a car, or applying for a credit card, your FICO score is a critical factor that lenders look at to decide if you’re creditworthy. This article will delve into what a FICO score is, how it’s calculated, and, most importantly, how you can optimize it for a healthy financial life.

Table of Contents

What Is a FICO Score?

A FICO score is a three-digit number that represents your credit risk based on information in your credit report. Created by the Fair Isaac Corporation (FICO), this score is used by the majority of lenders in the United States to evaluate a borrower’s reliability. While there are multiple versions and models of credit scoring, the FICO score remains the gold standard.

Key Takeaways

- The score ranges from 300 to 850, with higher scores indicating lower credit risk.

- It helps lenders predict how likely you are to repay a loan.

- A strong FICO score can yield better interest rates and broader access to credit.

Why Do Lenders Use FICO Scores?

Lenders employ FICO scores because they need a quick, data-driven approach to gauging the risk of lending money. A borrower with a high FICO score has a history of responsible credit management and poses less risk of default. In contrast, a low score may raise concerns about the borrower’s ability to repay the loan.

Why Your FICO Score Matters

Your FICO score can influence major life events. Here’s why it’s so important:

- Loan Approval: Banks and financial institutions usually have minimum credit score requirements. If your score is below their threshold, you might be denied credit altogether.

- Interest Rates: A higher credit score typically translates to lower interest rates. Even a slight percentage difference can save you thousands of dollars over the life of a loan.

- Insurance Premiums: Some insurance companies factor in your credit score when calculating premiums, so a better score could lower your monthly costs.

- Employment Opportunities: Certain employers check credit reports, especially for roles that deal with finance or sensitive information.

Bottom Line: Your FICO score can shape your financial landscape. Maintaining a good score doesn’t just improve your borrowing power; it can also help you save money and open up new opportunities.

The 5 Key Components of Your FICO Score

FICO scores are calculated from various pieces of your credit history. Five factors drive the score, each carrying a different weight. Let’s break them down:

- Payment History (35%)

- Credit Utilization (30%)

- Length of Credit History (15%)

- New Credit (10%)

- Credit Mix (10%)

Below, we’ll explore each factor in greater detail to understand why it matters and how to optimize it.

1. Payment History (35%)

Overview

Payment history is the single most important factor in your FICO score. It reflects how consistently you’ve paid your bills—be it credit cards, student loans, or mortgages—on time.

Why It Matters

Lenders want to see evidence that you fulfill financial obligations on schedule. A missed or late payment can significantly hurt your score. Severe delinquencies, such as collections or bankruptcies, are particularly damaging and stay on your report for several years.

How to Optimize

- Set Up Auto-Pay: Automating your payments ensures you never miss a due date.

- Use Payment Reminders: Most banks and credit card issuers offer text or email alerts.

- Pay in Full When Possible: Eliminating balances each month helps you avoid interest and maintain a spotless payment record.

Note: Even a single late payment can have a long-lasting effect, so consistency is key.

2. Credit Utilization (30%)

Overview

Credit utilization refers to the percentage of your available credit that you are currently using. Suppose you have a total credit limit of $10,000 across all cards and your total balance is $3,000. Your credit utilization ratio is 30%.

Why It Matters

A high credit utilization ratio can signal that you rely too heavily on credit, potentially indicating higher risk. Lenders view borrowers with lower ratios as more financially stable and better at managing credit.

How to Optimize

- Keep Utilization Below 30%: Many experts recommend using less than 30% of your total credit limit.

- Ask for a Credit Limit Increase: If you have a good payment history, your issuer might raise your limit, lowering your utilization (assuming you keep your spending the same).

- Pay Balances More Than Once a Month: Reducing your balance mid-cycle can help keep your reported utilization low.

Pro Tip: If you notice your balances creeping up, consider paying them down before the billing cycle ends, so the reported balance remains minimal.

3. Length of Credit History (15%)

Overview

The age of your credit accounts factors into your FICO score. This includes how long your oldest account has been open, the average age of all your accounts, and the age of specific accounts.

Why It Matters

A longer credit history provides more data for lenders to assess your habits. Young credit files can still have good scores, but generally, established accounts demonstrate consistent behavior.

How to Optimize

- Keep Old Accounts Open: Even if you rarely use a particular credit card, keeping the account open can extend your average account age.

- Avoid Opening Too Many Accounts at Once: Each new account lowers the average age and can bring down your score temporarily.

- Think Twice Before Closing an Account: Closing an older account could shorten your credit history.

Important: Don’t be too quick to close accounts once you’ve paid them off. You might inadvertently reduce your credit history length and increase your utilization ratio.

4. New Credit (10%)

Overview

New credit refers to how many new accounts you’ve opened recently, including any hard inquiries when you apply for credit. Multiple new accounts in a short period can be a red flag.

Why It Matters

Lenders worry you may be taking on more debt than you can handle if you open several accounts in rapid succession. Hard inquiries remain on your credit report for two years, but their impact on your score typically fades after 12 months.

How to Optimize

- Limit Credit Applications: Only apply for credit when necessary.

- Rate Shopping Tactically: When shopping for auto or mortgage loans, multiple inquiries within a short time frame usually count as one inquiry, minimizing score impact.

- Check Pre-Qualification: Before applying for a loan or credit card, see if you can get pre-qualified. This often uses a soft inquiry, which doesn’t affect your credit score.

Reminder: A single hard inquiry isn’t catastrophic, but several in a short period can collectively bring down your score.

5. Credit Mix (10%)

Overview

Your credit mix looks at the variety of credit accounts you have, such as credit cards, retail accounts, installment loans, and mortgages. Having multiple types of credit shows lenders you can handle various forms of debt responsibly.

Why It Matters

While it’s the smallest component of your FICO score, a diverse credit portfolio can give your score a slight boost. However, don’t open accounts just for the sake of diversity—only take on new credit if it aligns with your financial needs.

How to Optimize

- Diversify Gradually: If you only have credit cards, consider an installment loan (like a small personal loan) you can comfortably repay.

- Don’t Force It: Only open a new type of credit if it makes sense for your financial goals.

Note: Credit mix won’t make or break your overall score, but it can add a competitive edge if you manage everything else well.

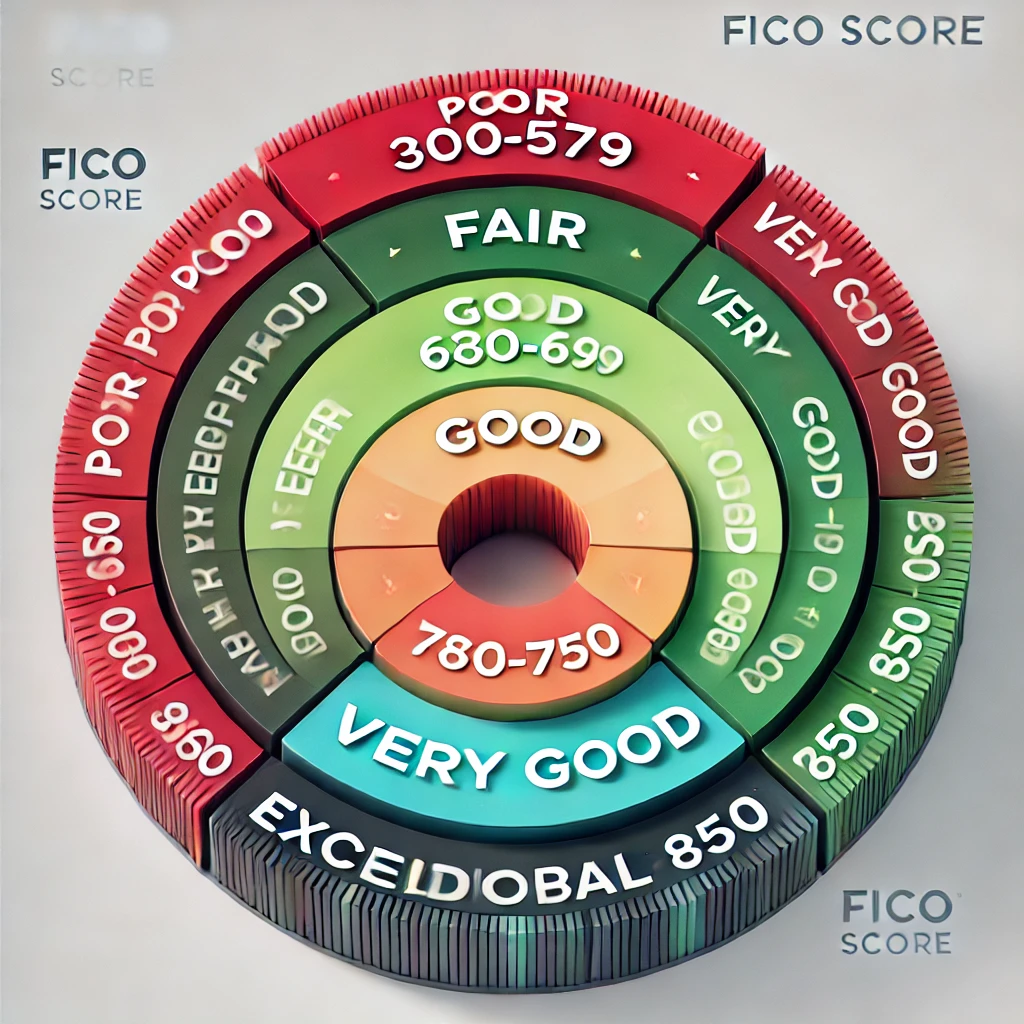

The FICO Score Ranges

FICO scores typically fall into five categories:

- Exceptional (800–850): Borrowers with scores in this range are viewed as highly reliable.

- Very Good (740–799): Indicates above-average creditworthiness; approvals and favorable terms are common.

- Good (670–739): Scores in this range are considered acceptable, though interest rates may not be as favorable.

- Fair (580–669): Indicates a higher risk level; borrowers might face limitations or higher costs.

- Poor (300–579): Lenders view this range as high risk, making approvals very challenging.

Why the Range Matters

Different lenders have their own definitions of what they consider “good” or “excellent.” However, generally speaking, you’ll secure better loan terms and higher credit limits if your FICO score lands in the upper tiers.

How to Check Your FICO Score

Staying informed about your credit health is essential. Here are some ways to monitor your FICO score:

- Bank or Credit Card Issuer: Many issuers offer free FICO score updates as part of your account benefits.

- Credit Bureaus: Equifax, Experian, and TransUnion all provide credit monitoring services that include FICO scores.

- myFICO.com: The official FICO website offers various products that give you direct access to your FICO scores and reports.

Frequency of Checks

- Monthly or Quarterly: Checking your score regularly helps you spot changes or errors quickly.

- Before Major Financial Moves: If you plan to buy a home or car soon, review your FICO score in advance to address any credit concerns.

Note: Checking your own FICO score generally results in a soft inquiry, which does not affect your credit.

Common Myths and Misconceptions About FICO Scores

There’s a lot of misinformation floating around about credit scores. Let’s debunk a few common myths:

- Myth: Checking Your Own Score Hurts It

- Reality: Self-checks are soft inquiries and do not affect your score.

- Myth: You Only Have One FICO Score

- Reality: You have multiple FICO scores, as each credit bureau may have slightly different data. Plus, FICO updates scoring models periodically.

- Myth: Closing a Paid-Off Card Always Helps

- Reality: Closing an old card can shorten your credit history and potentially increase your credit utilization, which might lower your score.

- Myth: Carrying a Small Balance Improves Your Score

- Reality: It’s best to pay off your balances in full whenever possible. Consistent on-time payments boost your score more than carrying a balance.

- Myth: Once a Late Payment Is on Your Report, There’s Nothing You Can Do

- Reality: You can try writing a goodwill letter to the lender or disputing inaccuracies with the credit bureaus. While success isn’t guaranteed, it can sometimes help.

How to Improve Your FICO Score

Optimizing your FICO score isn’t complicated if you follow best practices. Here are some strategic steps:

- Pay Bills on Time

- Set up auto-pay or reminders. Even one late payment can have a lasting impact.

- Lower Your Credit Utilization

- Pay down existing balances and keep usage below 30%. If you can manage 10% or less, that’s even better.

- Build a Positive Credit History

- Keep older accounts open to extend your credit age. If you’re just starting, consider a secured credit card or a credit-builder loan.

- Be Selective With New Credit

- Multiple credit applications in a short time frame can lower your score. Spread out your applications and only apply when needed.

- Dispute Errors

- Check your credit reports for inaccuracies. If you find any, file disputes with the credit bureaus (e.g., FTC guidelines or the official AnnualCreditReport.com).

- Request Higher Credit Limits

- If you have a good payment history, ask for a limit increase to lower your utilization ratio. Just avoid overspending once you have more available credit.

- Plan Large Purchases

- If you know you’ll need to carry a balance (like for a big home renovation), time your application for new credit or large expenses when your score is at its best.

Practical Ways to Manage Credit Day-to-Day

Good credit management is a long-term commitment. Here are some everyday tips:

- Keep Track of Due Dates: Maintain a digital or physical calendar to avoid missing payments.

- Use Financial Apps: Tools like Mint or YNAB (You Need A Budget) can help you monitor spending and credit usage in real-time.

- Keep Personal Savings: Having an emergency fund reduces the need to rely on credit.

- Review Statements: Check for unauthorized charges or errors monthly; the sooner you catch them, the easier they are to fix.

Real-World Example: A Tale of Two Borrowers

Let’s consider two hypothetical individuals:

- Alice

- Score: 780

- Habits: Always pays on time, credit utilization around 10%, credit history of 10 years.

- Outcome: Low interest rates on mortgages and auto loans, frequent credit card offers with excellent terms.

- Bob

- Score: 630

- Habits: Has several late payments, credit utilization around 70%, and has opened three new credit cards in the past six months.

- Outcome: Denied for premium credit cards, higher interest rates on a car loan, and struggles with monthly payments.

The difference between Alice and Bob underscores the long-term benefits of responsible credit behavior.

Using Credit Responsibly Without Fear

For many, the word “credit” can trigger anxiety. But using credit responsibly can empower you to reach major milestones, from homeownership to business funding. The key lies in consistent, informed management:

- Regularly Monitor: Keep tabs on your credit report and FICO score.

- Stay Disciplined: Resist the urge to overspend just because you have available credit.

- Educate Yourself: Financial literacy resources, such as the Consumer Financial Protection Bureau (CFPB) site, offer guidelines to help you maintain a healthy credit profile.

Preparing for Big Financial Decisions

If you’re gearing up for a large purchase or loan:

- Check Your Score Early: Plan at least six months in advance to improve your score if needed.

- Resolve Delinquencies: Pay off any past-due balances and negotiate with creditors if possible.

- Avoid New Debt: Refrain from opening new lines of credit that could hurt your FICO score or debt-to-income ratio.

Mistakes to Avoid

Even well-intentioned individuals can stumble when it comes to credit. Here are some pitfalls to avoid:

- Ignoring Your Report: Errors left uncorrected can drag down your score for years.

- Misusing Balance Transfers: A 0% APR offer can help pay off debt, but only if you manage it responsibly and don’t rack up new balances.

- Over-leveraging: Taking on too many loans or credit lines can overextend your finances and harm your score.

- Panic Closing Accounts: Closing a long-standing card might provide emotional relief, but it can also reduce your score by shortening credit history.

13. Frequently Asked Questions (FAQs)

Q: How often does my FICO score update?

A: Your FICO score updates whenever new information is reported by your creditors to the credit bureaus. Most issuers report monthly, but the exact timeline can vary.

Q: Will co-signing a loan affect my FICO score?

A: Yes. If the primary borrower misses payments, that negative information appears on your credit report as well.

Q: How can I boost my score quickly?

A: Paying down high credit card balances and disputing errors can lead to relatively quick score increases. However, building solid credit habits is the surest way to see sustained improvements.

Q: Do landlords check FICO scores?

A: Paying down high credit card balances and disputing errors can lead to relatively quick score increases. However, building solid credit habits is the surest way to see sustained improvements.

Q: Is it ever beneficial to close a credit card?

A: Sometimes. For instance, if the card has a high annual fee and you’re not using it, it might be worth closing. Just weigh the impact on credit utilization and length of credit history.

Conclusion: The Power of an Informed Credit Strategy

Your FICO score plays a central role in your financial life. From securing favorable interest rates to qualifying for premium credit products, a strong score offers numerous benefits. By focusing on payment history, credit utilization, credit length, new credit accounts, and credit mix, you can shape a robust FICO profile that stands up to lender scrutiny.

Remember, credit is a tool. Used wisely, it can help you build a secure financial future. With consistent monitoring and responsible habits, your FICO score will reflect your commitment to financial health, providing the foundation you need for long-term stability and success.