Introduction

Compound interest is one of the most powerful forces in personal finance, often described as the “eighth wonder of the world.” It can transform modest contributions into substantial wealth over time, yet many people misunderstand or underestimate its potential. In this article, we’ll explore how compound interest works, why it matters for your financial future, and how you can harness its power to grow your wealth. By the end, you’ll be equipped with strategies to let your money work harder and faster for you—so you can meet and exceed your financial goals.

What Is Compound Interest?

Compound interest is the process by which the interest you earn on an initial principal also earns interest over subsequent periods. Instead of receiving a set amount of interest solely on the original principal (simple interest), you accumulate earnings on both the principal and the interest that’s been added previously. Over time, this snowball effect can dramatically increase your total return.

A Simple Formula

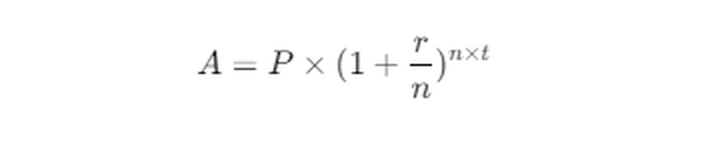

A commonly used formula for compound interest is:

where:

- A = the amount of money accumulated after n years, including interest

- P = the principal amount

- r = the annual interest rate (in decimal form)

- n = number of times that interest is compounded per year

- t = time the money is invested (in years)

Simple Interest vs. Compound Interest

To appreciate the difference, let’s compare simple interest to compound interest using a quick example:

- Simple Interest: You invest $1,000 at 5% simple interest annually. After one year, you earn $50. After ten years, you earn $500 on your original principal (total $1,500).

- Compound Interest: You invest $1,000 at 5% compounded annually. After one year, you still earn $50. However, in the second year, interest is calculated on $1,050, so you earn $52.50. By the tenth year, your total will be more than $1,600. The additional amount is the magic of compounding.

Even though the interest rate is the same, compound interest grows your money faster because each year’s interest earns interest in the following years.

Why Compound Interest Matters

- Exponential Growth

Over long periods, compound interest can lead to exponential growth. Early contributions in a savings or investment account can multiply significantly if given enough time to compound. - Motivation to Start Early

The earlier you start saving or investing, the more time compound interest has to work in your favor. Even small amounts can become large sums if they’re allowed to compound over decades. - Passive Wealth Building

Once you set up an automatic investment or savings plan, compounding works behind the scenes, requiring minimal additional effort on your part. Your money literally works for you.

Real-World Examples

- Retirement Accounts (401(k), IRA)

Let’s say you start investing $200 per month at age 25 in a tax-advantaged retirement account with an average 7% annual return. By age 65, you could accumulate several hundred thousand dollars more compared to someone who starts the same contributions at age 35. The difference arises purely from the extra decade of compounding. - Dividend Reinvestment

Many stock investors reinvest their dividends back into purchasing more shares. Over time, these extra shares also earn dividends, accelerating the compounding effect. - High-Interest Savings Accounts

Even a modest APY (Annual Percentage Yield) can add up. If you reinvest the earned interest, you’ll see your balance grow more quickly than in a standard checking account that yields little to no interest.

How to Harness the Power of Compound Interest

- Invest Regularly

Make automated contributions to your investment or savings account. This consistent flow of money can generate a reliable compounding effect over the years. - Start As Early As Possible

Time is the most critical ingredient. Even if you can only invest a small amount, starting in your 20s gives you a huge advantage over waiting until your 30s or 40s. - Reinvest Earnings

Whenever possible, reinvest your dividends, capital gains, or interest payments. Compounding becomes much stronger when you continuously add your returns back into your investments. - Choose Growth-Oriented Assets

Look for assets such as stocks, index funds, or mutual funds that have higher growth potential. While they may carry higher risk, they can also offer more significant compounding over the long term. - Keep an Eye on Fees

High management fees or transaction costs can erode your compounding gains. Choose low-cost index funds or ETFs to maximize returns.

Common Mistakes to Avoid

- Delaying Investments

Procrastination is the enemy of compounding. The sooner you begin, the more powerful the effect. - Taking on Excessive Risk

While growth assets can amplify returns, overleveraging or chasing speculative investments can wipe out your gains. Balance risk with your long-term goals. - Withdrawing Earnings Too Soon

If you withdraw your returns instead of reinvesting them, you effectively halt the compounding process. Discipline is key. - Ignoring the Impact of Fees

Even seemingly small fees, like 1-2% management costs, can substantially reduce returns when compounded over decades.

Final Thoughts

Compound interest has the power to transform your financial future. By understanding its mechanics and starting early, you can make time work in your favor. Regular investments, reinvested earnings, and consistent discipline can significantly accelerate your wealth-building journey. As you watch your money grow, you’ll see how the compounding principle rewards patience and long-term thinking.

If you’re ready to take advantage of compound interest, start today. Open a high-yield savings account or automate monthly contributions to an investment portfolio. Each dollar you invest and reinvest puts you one step closer to long-lasting financial security and freedom.

Ready to let your money work for you? Begin by reviewing your current savings or investment options. Explore high-yield accounts, index funds, or employer-sponsored retirement plans. Make compound interest your ally, and watch your wealth multiply over time.