-

Tax Brackets Explained: Where Does Your Income Fall?

Understanding tax brackets can help you legally lower your tax bill. Learn how they work and what strategies can help you keep more of your income.

-

Part-Time vs. Full-Time Freelancing: Financial Trade-Offs

Freelancing offers flexibility, but should you go full-time or keep it as a side hustle? Weigh the pros and cons to choose the best path for you.

-

Options Trading 101: Calls, Puts, and Strategies

Options trading can boost your portfolio, but it comes with risks. Learn how calls, puts, and key strategies work before making your first trade.

-

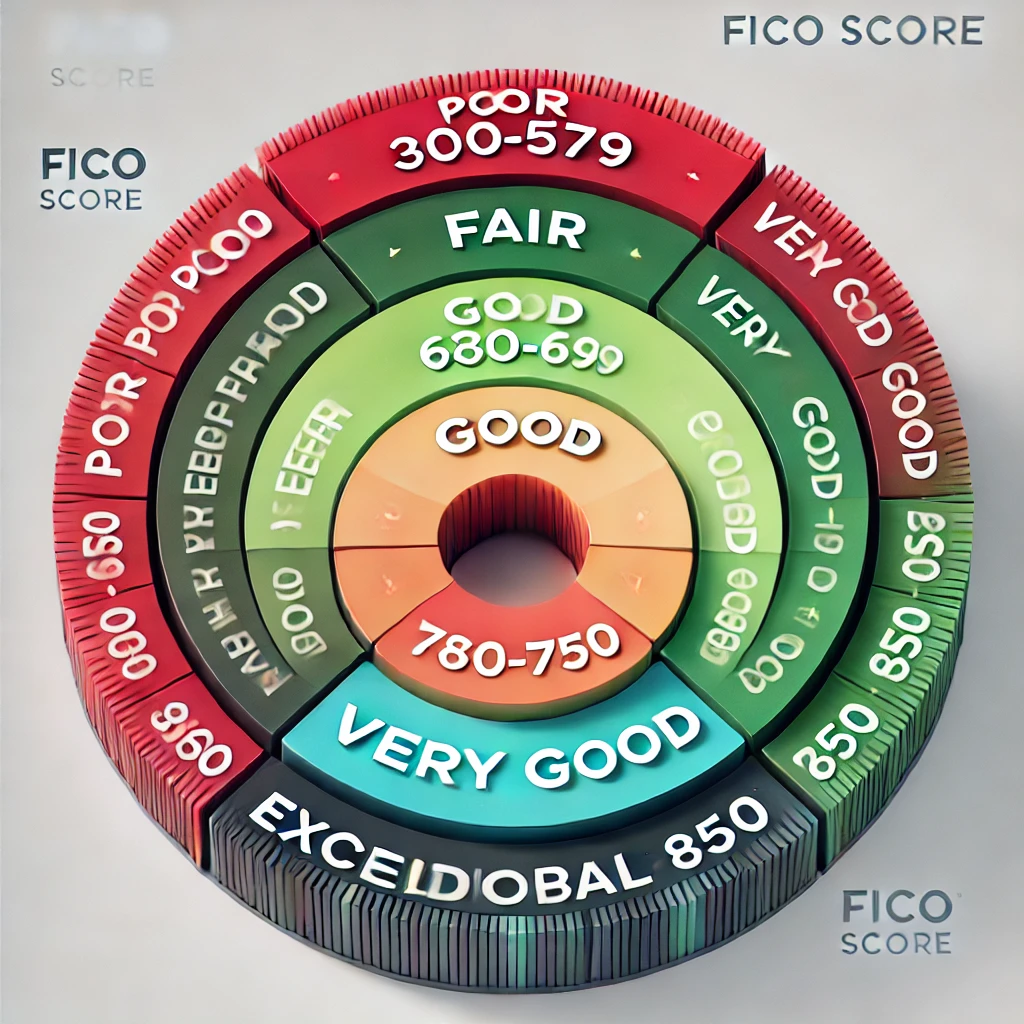

Understanding the FICO Score: Factors That Matter Most

Your FICO score affects loans, interest rates, and credit. Discover the key factors that influence your score and how to improve it.

-

High-Yield Savings Accounts: Are They Still Worth It?

With rising interest rates, are high-yield savings accounts still a smart choice? Explore the benefits and downsides before deciding where to save.

-

Understanding Market Cycles: Bull and Bear Phases

Markets rise and fall, but understanding bull and bear cycles can help you make better investment decisions. Learn what drives these trends.

-

Best Strategies to Maximize Compound Interest and Grow Your Wealth

Compound interest is the key to long-term wealth. Learn proven strategies to make your money work for you and maximize your financial growth.

-

Should You Invest in S&P 500 Index Funds?

S&P 500 index funds offer diversification and steady returns. But are they the best choice for your portfolio? Here’s what every investor should know.

-

2025 Fundamental Revenue, Earnings & Margins Guide

Understanding revenue, earnings, and profit margins is key to stock analysis. This guide breaks down the metrics that will define the 2025 market.

-

Comparing Growth Stocks vs. Value Stocks

Growth or value stocks—which strategy builds wealth faster? Learn the key differences and find out which approach suits your investment goals.

-

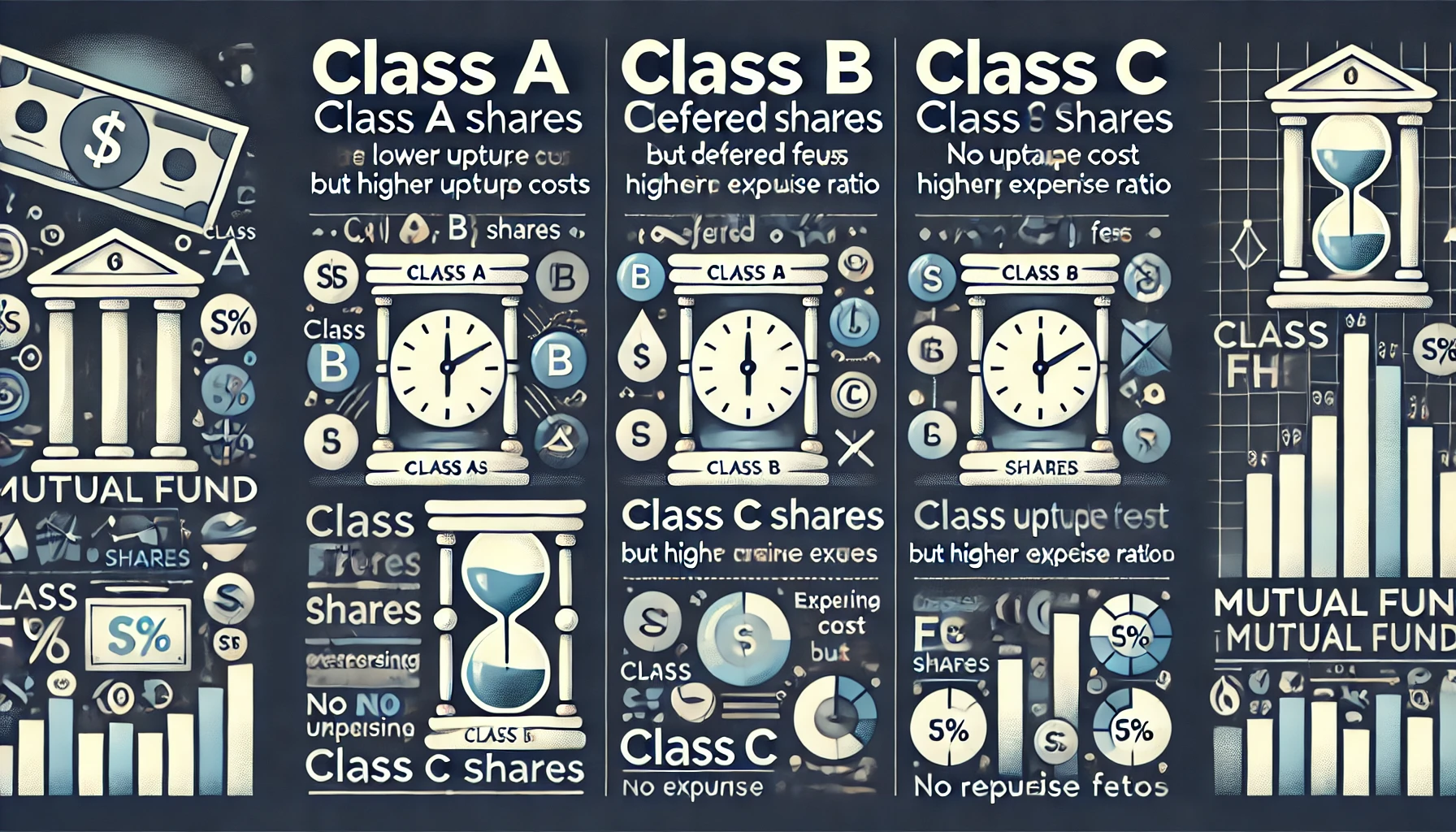

Mutual Fund Classes: A, B, C Shares—What’s the Difference?

Mutual funds come in different share classes, each with unique fees and benefits. Here’s how to pick the right one for your financial goals.

-

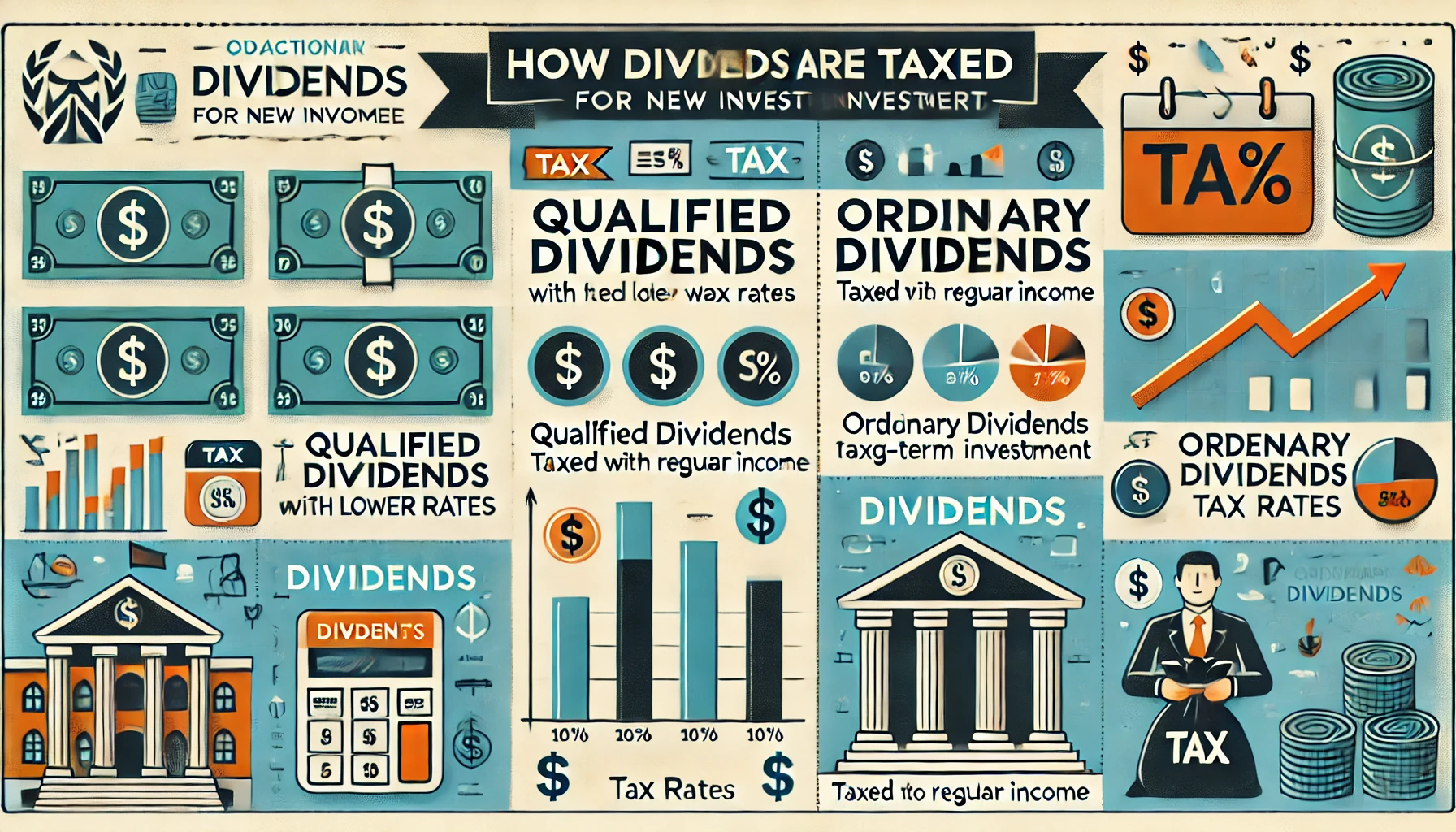

How Dividends Are Taxed: A Quick Guide for New Investors

Dividend investing can boost your income, but taxes can eat into profits. Learn how dividends are taxed and what strategies can reduce your tax burden.

Categories

- Advanced Investing

- Budgeting & Money Management

- Credit Building & Management

- Cryptocurrency & Blockchain

- Debt Management

- Financial Education & Mindset

- Income Generation

- Insurance & Risk Management

- Investing Basics

- Real Estate & Alternative Investments

- Retirement Planning

- Saving Strategies

- Tax Planning